An In-Depth Look at Commercial to Residential Conversions—Part 9

Welcome to part 9 in our on-going series on commercial to residential conversions, a commercial real estate trend that has been gaining momentum over the past decade, especially since the height of the pandemic five years ago.

In part 8, we discussed many of the reasons the number of office to residential conversions is skyrocketing, including the current state of the US multifamily market compared to the current state of the US office market and the reasons why the multifamily sector has been so resilient in recent years. We left off with the main driver of the multifamily market as of late — the current state of the US housing market. We’ll pick up the discussion from there.

The US Housing Market Remains Sluggish

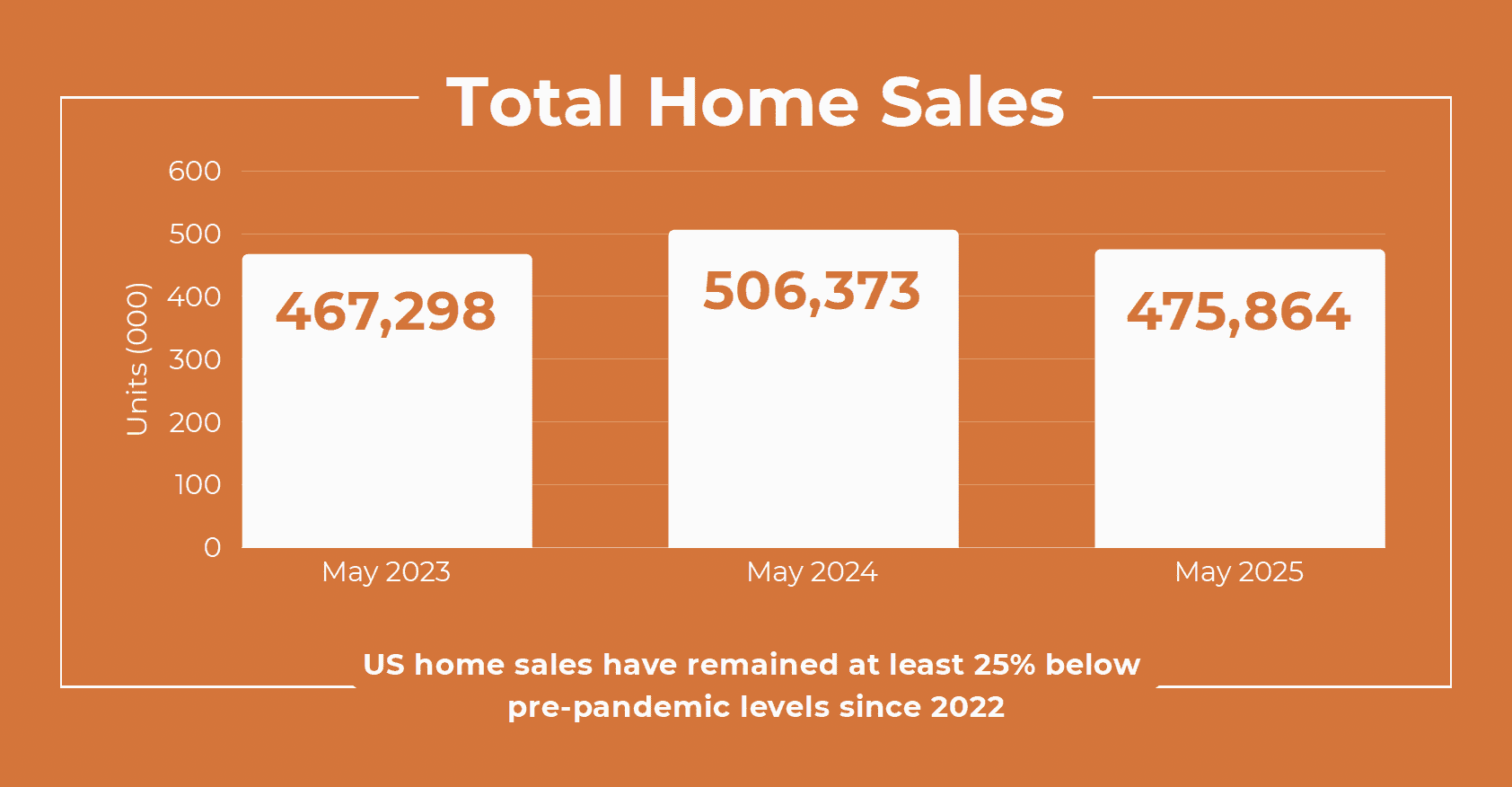

Entering Q3 2025, the US housing market remains sluggish. Over the past three years, home sales have been at only 75% of pre-pandemic levels, reports Bankrate. Newsweek reports that in May 2025, a total of 475,864 homes sold in the US, down 6% from the 506,373 sold in May 2024. However, May 2025’s sales are a 1.2% increase from May 2023, when a total of 467,298 homes were sold.

According to data from Redfin, in May 2025, the median sale price of a typical US single family home was $441,526, down 4.7% YOY from $437,963. Home price growth has slowed considerably, primarily due to a steep buildup of inventory over the past two years. In May 2025, there were 2,058,065 homes listed for sale in the US, up 14.1% YOY. This is on top of a 17.8% increase in inventory from May 2023 to May 2024. Redfin estimates that home sellers currently outnumber buyers in the US by 500,000.

Single Family Home Mortgage Rates Remain Elevated

Mortgage rates have dropped slightly as of late but have remained elevated over the past four years. The Wall Street Journal reports that on June 27, 2025, the average 30-year fixed rate mortgage rate was 6.75%, down 16 bps from January 2, 2025, when it stood at 6.91%. That’s still considerably higher than in early 2022, when it was 4.72%, and over twice as high as in 2021, when the 30-year fixed rate dipped below 3%.

Earlier this year, housing experts predicted that mortgage rates would drop substantially in 2025, but have since adjusted their outlook, now predicting that mortgage rates will moderate by EOY 2025, but not fall significantly, reports Bankrate. Morningstar forecasts that the average 30-year fixed mortgage rate will drop to 5.6% in 2026 and 5.0% in 2027.

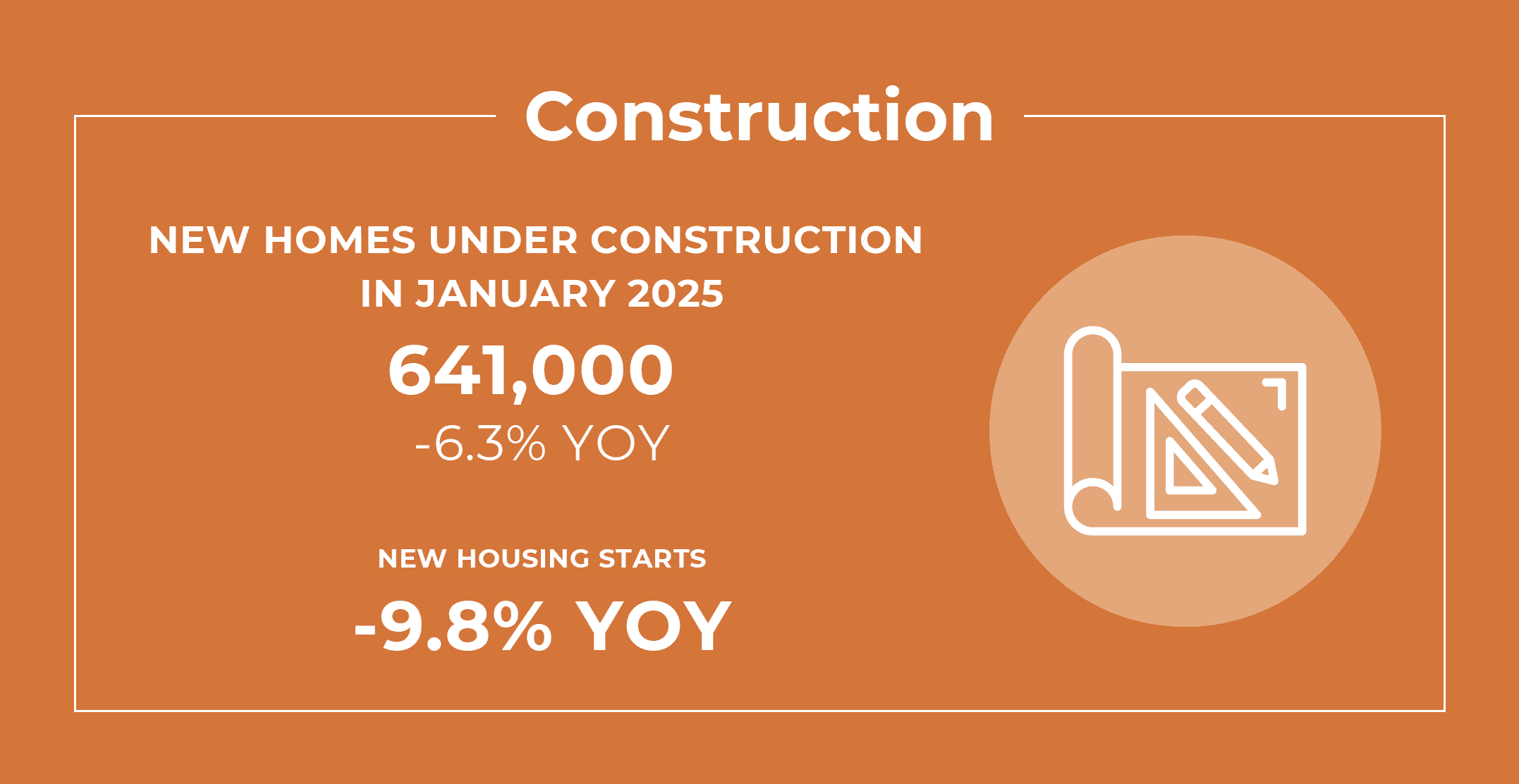

Home affordability—or lack thereof– and high construction costs have impacted new home construction. In January 2025, 641,000 new single-family homes were under construction, down 6.3% YOY, reports the National Association of Home Builders.

In addition, new housing starts fell by 9.8% YOY to a seasonally adjusted rate of 1.37 million units, which equates to the total number of new homes that would be built in the US by year’s end if construction continued at its current pace. The annualized unit rate for single family permits was 996,000 in January 2025, unchanged MOM.

Home Builders Are Cutting Prices, Offering Incentives

To help boost new home sales, 34% of builders cut home prices in May 2025, with an average price reduction of 5 percent, according to the NAHB. In addition, 61% of builders were offering some form of sales incentives to entice buyers. To help make new homes more affordable, homebuilders have been reducing base prices and offering smaller floor plans and lot sizes, reports Morningstar.

US Housing Market Expected to Remain Slow Through 2025

Many residential real estate experts predict the US housing market will remain slow for the remainer of the year, reports Bankrate. Many potential buyers put off purchasing a new home the last two years, hoping that mortgage rates would fall and make homes more affordable, and that trend has continued into the second half of 2025.

Newsweek reports that housing experts expect demand for single-family homes to remain flat for the next six months, putting downward pressure on prices until they start falling by the end of the year.

President Trump’s One Big Beautiful Bill

While the housing market’s struggles have helped the multifamily sector, residential real estate should receive a big boost from the many economic and housing stimulus measures included in the “One Big Beautiful Bill Act”, the massive, 870-page, $2.4 trillion tax and spending bill recently approved by both the House and Senate and signed into law by President Trump in a July 4th White House ceremony.

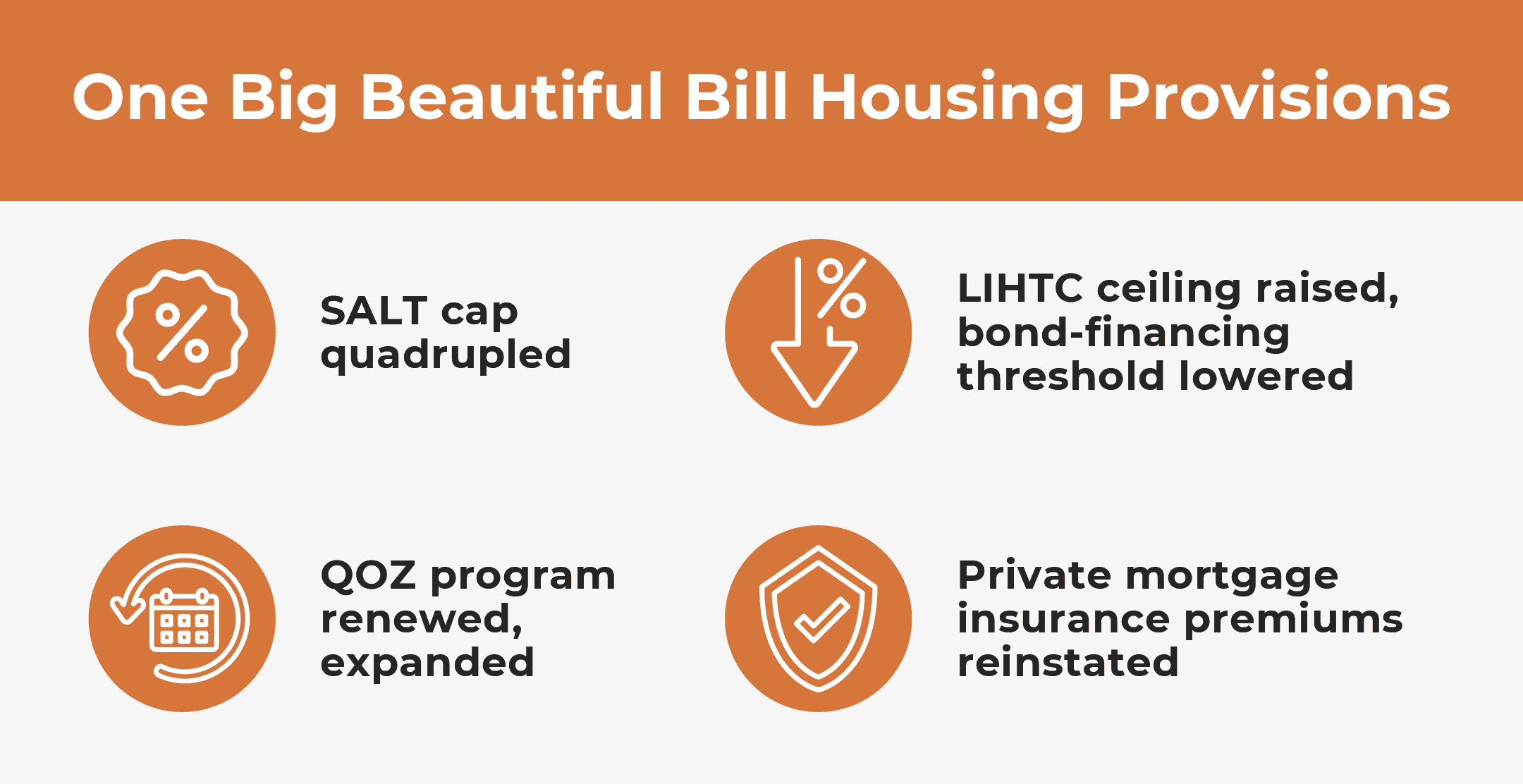

Measures in the bill specifically meant to help stimulate both the single family and multifamily housing markets in the US include:

- Quadrupling the state and local tax (SALT) deduction cap from $10,000 to $40,000 in 2025, after which point it will grow by 1% each year until 2029. The deduction has a $500,000 annual income threshold, after which the amount of the allowable deduction decreases. Raising the SALT deduction cap was meant to reduce taxpayers’ tax burdens, putting more money in their pockets.

- Renewal of the Qualified Opportunity Zone (QOZ) program, originally introduced in 2017 during Trump’s first term, and the generous tax incentives it offers to commercial real estate developers and investors. The new bill also expands the QOZ program to rural areas to promote CRE development outside of urban cores.

- Permanently increased the state allocation ceiling for Low-Income Housing Tax Credits (LIHTC) by 12% and lowered the bond-financing threshold for developers to 25% from 50%, both to encourage more development of affordable housing.

- Reinstates private mortgage insurance premiums, allowing homeowners to deduct them from their taxes to reduce their tax liability.

- Housing advocates estimate the new tax bill and other policy changes could spur the creation of over 500,000 new housing units, which would help relieve the US’ ongoing housing shortage.

Repealing Labor Wage Laws to Boost Housing Construction

In addition to the proposed pro- multifamily measures in the new tax bill, the Trump administration has stated it plans to repeal the Davis-Bacon laws requiring real estate developers of federally funded projects to pay all workers prevailing wages, which some believe hinders development of affordable and low- and moderate-income housing.

Potential Headwinds for The Multifamily Sector

While things are looking up for the multifamily sector, some potential challenges lie ahead.

The Potential Impacts of US Trade Policies on Multifamily Real Estate

The first is uncertainly over future US economic and trade policies, especially President Trump’s proposed tariffs, which is already weighing on most commercial real estate sectors, capital markets and the economy in general.

In the global economy, everything is interconnected. US tariffs and retaliatory tariffs from other countries would likely ripple through the US and foreign economies, raising the costs of many goods and services, including materials for multifamily construction, which would put even more of a damper on multifamily construction, reducing multifamily supply over the next few years.

Interest Rates Could Remain Elevated

While inflation has been on a downward path, if the CPE starts rising again, the Fed would be hesitant to cut interest rates anytime soon, as many have been hoping, leaving borrowing costs elevated. This would hurt borrowers’ ability to refinance the huge wave of multifamily loans maturing between 2025 and 2032, potentially leading to more non-performing loans, loan extensions and loan workouts and maybe even a rise in foreclosures.

Keeping interest rates at their current levels would also keep the cost of financing multifamily acquisitions high, suppressing investment sales. Financing costs for new multifamily construction and multifamily conversions would also remain high. Like in the current environment, many projects wouldn’t pencil out, reducing the number of new projects and new supply. For consumers, higher interest rates mean less purchasing power, which would slow multifamily rent growth.

US Labor Market Showing Signs of Slowing

In addition, the US labor market has been showing signs of slowing. In May 2025, the US unemployment rate was around 4.2%, a 20 bps increase from the year before. That translates to approximately 7.2 million Americans actively looking for work out of a labor pool of approximately 171 million workers. Recently, many prominent US corporations have announced big layoffs, including Disney, UPS, Amazon and Proctor & Gamble, as did the Federal government. Fewer people working means fewer new household created, which would hurt demand for apartments.

Trump Administration’s Immigration Policies

Another potential political issue for the multifamily sector: the Trump administration’s immigration policies. The construction industry relies heavily upon migrant labor. As the administration aggressively deports foreign nationals and migrants keep lower profiles, the construction labor pool is shrinking, increasing already high labor costs and delaying multifamily projects and apartment conversions. Also, migrants comprise one of the biggest segments of renters, so more deportations reduces demand for apartments.

Next, Public Incentives Meant to Spur Office to Apartment Conversions

That concludes our look at the US housing sector and potential US economic and immigration policies that could boost or hinder the multifamily sector.

Next, we’ll look at the growing number of federal, state and local government incentives and policies meant to help increase the number of commercial to residential conversions, especially office to apartment conversions.

More Resources on Commercial to Residential Conversions

In case you missed any of our previous posts on commercial to residential conversions, here are links to all of them as well as the topics covered. While some of the posts are a little older, they provide a helpful context for residential conversions today:

In addition, there are two new infographics in our Library. One provides a concise update on Office to Residential conversions, the other is an update on the US office market. Both are based on the latest data available as of early Q3 2025.

Unmatched Skills, Experience and Know-How

Realogic has over three decades of experience working on all types of commercial real estate transactions, with all types of commercial real estate assets and on adaptive reuse projects. Our expert team has the skills, knowledge and know-how to help make any commercial to residential conversion, whether it’s the conversion of an office building, hotel, retail space or former factory or warehouse, an unqualified success. Our full suite of commercial real estate services and solutions includes:

- Underwriting

- Due Diligence

- Financial Modeling

- Lease Abstraction

- Loan Abstraction

- Closing Support

- Off The Shelf Excel Models for Development

- Non-Performing Loans/Distressed Assets

- Opportunity Zone Help

For more information, contact us at info@www.realogicinc.com or 312-782-7325

About the Author

Terry Banike is Vice President of Marketing for Realogic. Over the course of his career, he has worked in marketing, communications, journalism and public relations, and has written news stories and features for newspapers, trade publications, newsletters and blogs. A rabid reader of anything and everything on commercial real estate, Terry follows commercial real estate news and trends closely and frequently posts about real estate on the Realogic Blog. He can be reached at tbanike@www.realogicinc.com.

Sources:

- Bankrate; Housing Market Predictions For the Rest of 2025; Andrew Dehan, Michelle Petry; June 9, 2025

- Newsweek; Graphs Show How 2025 Housing Market Compares to 2024 So Far; Giulia Carbonaro; June 17, 2025

- Morningstar; Understanding the US Housing Market in 2025: Mortgage Rates, Affordability, and Growth Trends; Brian Bernard; May 19, 2025

- National Association of Home Builders; Eye On Housing; Housing Starts Retreat at the Start of 2025; Robert Dietz; February 19, 2025

- Fox Business; American Homeowners and Families Get Relief With The ‘One, Big Beautiful Bill’; Aislinn Murphy; July 23, 2025

- Homes.com; Here’s what the ‘One Big Beautiful Bill’ means for homeowners and housing; Rebecca San Juan; July 10, 2025

- Fortune; Trump Signs ‘One Big Beautiful Bill’ Into Law: What That Means For Your Money; Alicia Adamczyk; July 4, 2025

- The Wall Street Journal; Mortgage Rates Today, June 27, 2025: 30- Year Rates Drop to 6.75%; Miranda Marquit; June 27, 2025

- Bloomberg Law; Labor Department Targets Dozens of Rules for Deregulatory Push; Rebecca Rainey; July 1, 2025

- USA Facts; What is the unemployment rate in the US right now? May 2025

- Intellizence; Companies That Announced Major Layoffs and Hiring Freezes; July 30, 2025