An In-Depth Look at Multifamily Conversions – Part 6

Much about commercial real estate and the economy has changed since our last post on multifamily conversions, so we felt it was time for an update.

Office Vacancies Skyrocket

Office vacancies spiked steeply during the height of the pandemic, when lockdowns, mandates and social distancing forced many people to work from home or on a hybrid office-remote schedule. Once the pandemic began to ebb, widespread anticipation was that workers would return to the office in force, eventually filling office buildings to pre-pandemic levels again.

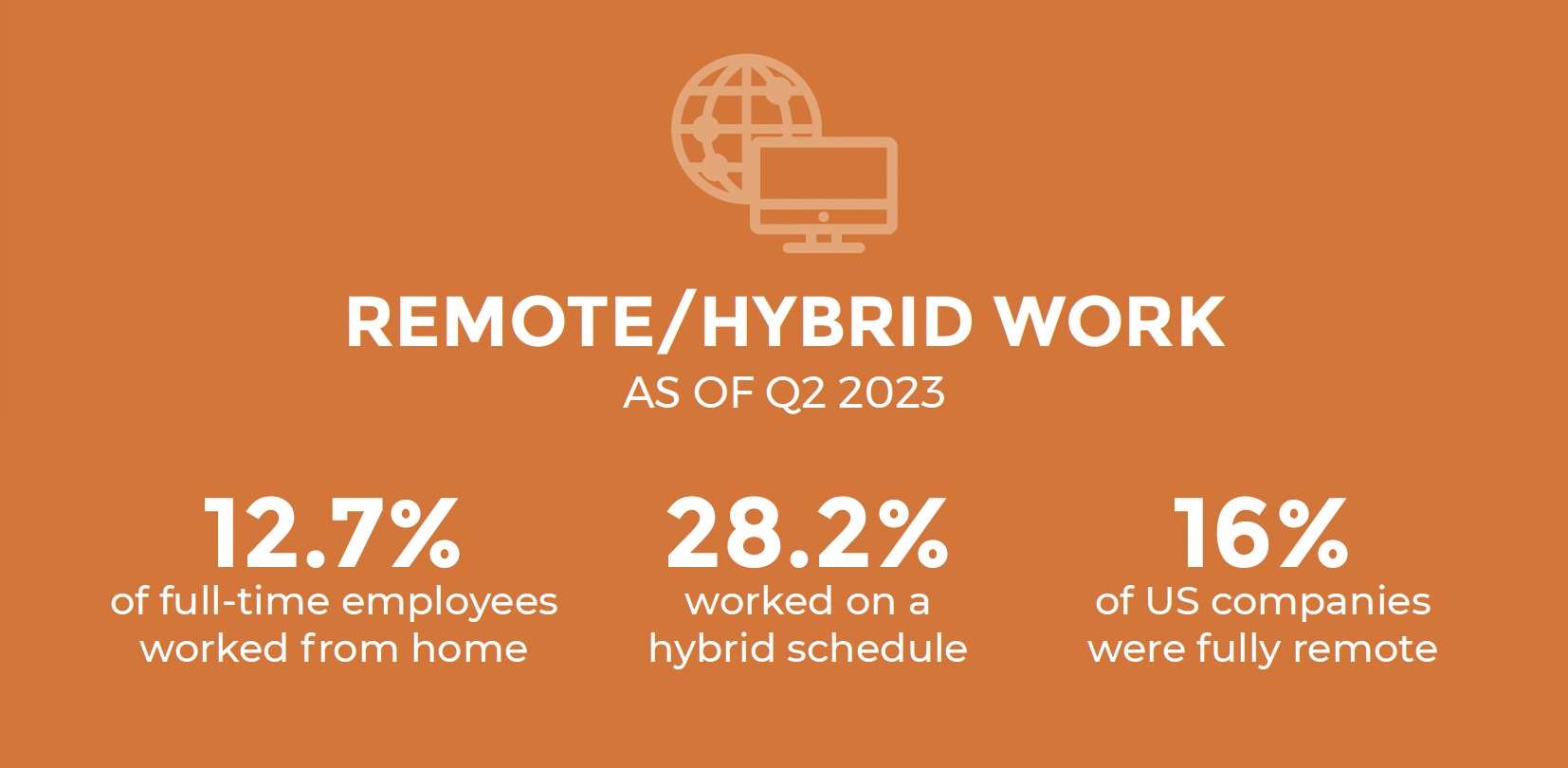

But, that optimistic scenario never materialized. As of September 2023, RTO averaged around 47% in the 10 largest US cities, far below expectations for this point. Many workers in the US—12.7%– were still working remotely full-time while 28.2% were on a hybrid schedule. 16% of all US companies were operating fully remote.

As a result, the office vacancy rate has risen since the onset of the pandemic, not fallen as was widely expected. As of Q2 2023, the average office vacancy rate in the US was 18.6%, over 4% higher than in Q4 2019, the last full quarter before the pandemic began.

With many employees looking to work remotely or on a hybrid schedule permanently, and many companies accommodating them to attract and retain top talent, it appears that remote and hybrid work are here to stay and office vacancies are likely to continue rising for at least the next 12 months.

The Impact of Remote, Hybrid Work on Commercial Real Estate

The widespread shift to remote and hybrid work has triggered several trends that are impacting the office sector, capital markets, big cities’ Central Business Districts and commercial real estate in general, including multifamily conversions.

Many Office Occupiers Downsize

Many office occupiers have been downsizing their spaces significantly, adding to the amount of vacant office space on the market. Colliers reported in July 2023 that downsizing has become the norm for large office occupiers, who are typically reducing their office space by 20%-30% on new leases and renewals.

Office Subleasing Spikes

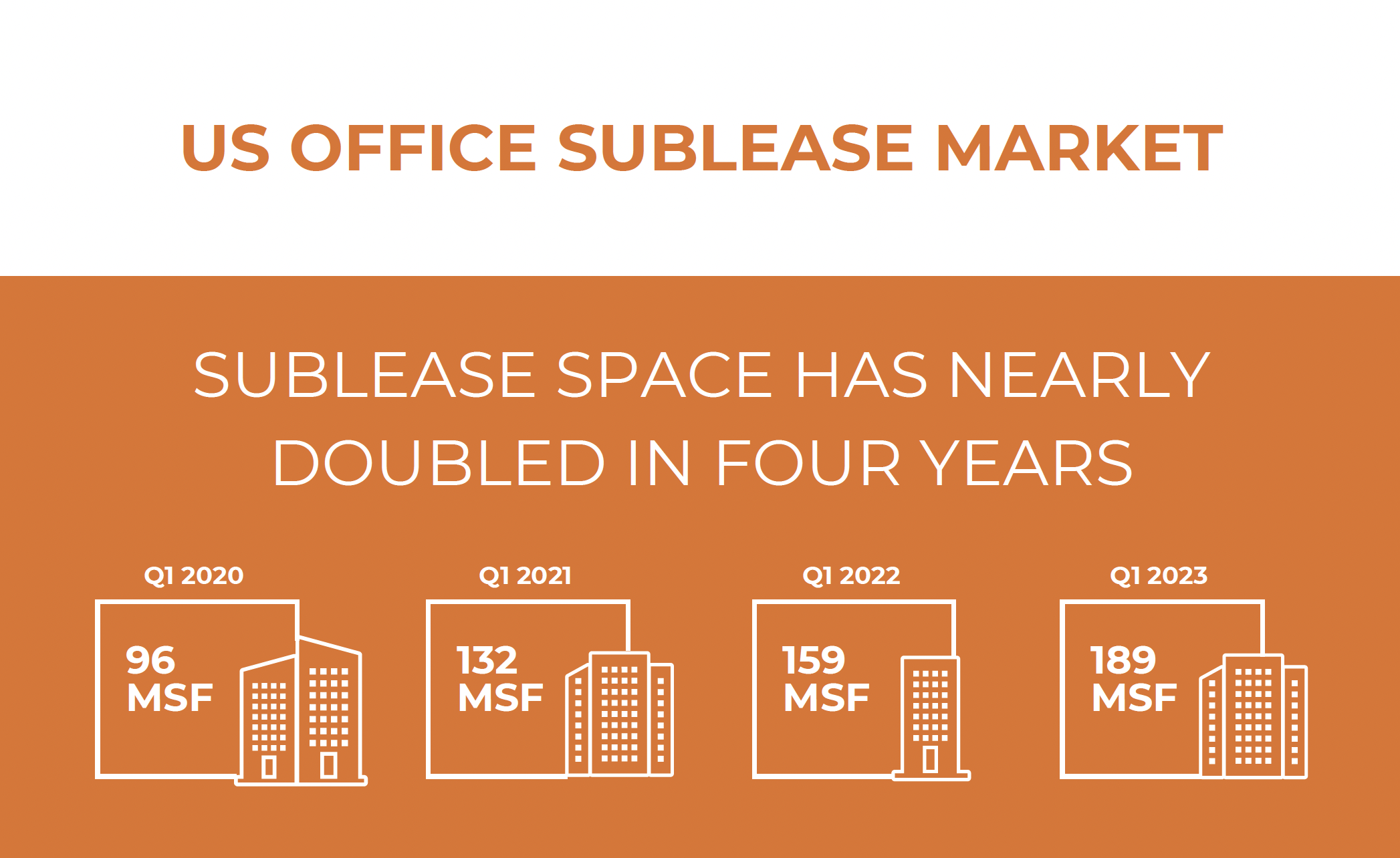

Also, many office tenants have been subleasing space. Between Q1 2020, the quarter the pandemic began, and Q1 2023, the amount of office sublease space available in the US nearly doubled, to 189 msf from 96 msf. Class A downtown sublease space was reportedly being offered at a 30% discount to direct space in leading markets in Q2 2023.

The Flight to Class A Office Buildings

Of the companies that are maintaining or expanding their office footprint, many are moving to newer, high-end office buildings with in-demand amenities to coax their workers back to the office and to recruit and retain talent. As a result, older Class B and C office buildings have seen a disproportionate increase in vacancies compared to Class A office buildings. According to GlobeSt., in Q4 2022, the vacancy rate for Class B and C office building in New York City was 12.2% vs 10.4% for Class A properties—over 2% higher. This flight to quality is causing many older office buildings to struggle financially and become distressed assets.

Non-Performing Loans and Distressed Assets Multiply

The huge rise in office vacancies the last few years is bleeding into capital markets too. Fewer tenants and more vacant space mean less cash-flow so many office landlords have become unable to cover the debt service on their distressed assets, especially on Class B and C office buildings.

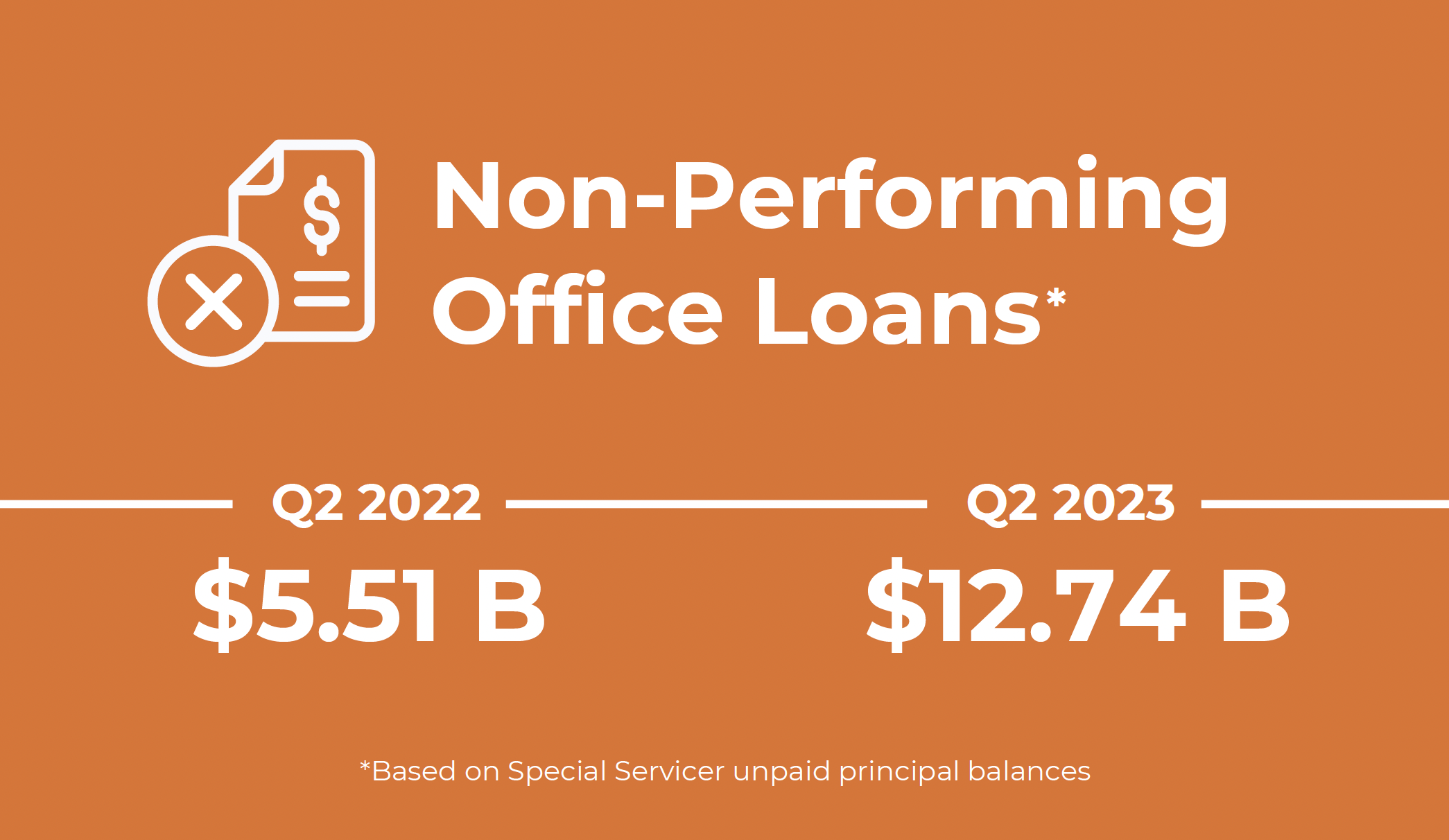

This has resulted in a growing swell of non-performing loans for distressed office buildings, overwhelming banks and other lenders. Reuters reported that as of June 2023, CMBS special servicers, which handle distressed loans, had a combined unpaid principal balance of $12.74 billion in office loans, more than double the $5.51 billion from a year ago.

And, with commercial real estate data provider Trepp reporting that approximately $20 billion in office CMBS loans are maturing in 2023, that amount will surely grow, leaving lenders holding large portfolios of non-performing loans collateralized with distressed office assets.

Distressed Assets’ Impact on Big Cities’ Finances

The distress in the office sector is also impacting the finances of big US cities. Many distressed office buildings are located in the Central Business Districts of major US cities and are a critical source of property tax revenue for those cities; it’s estimated that the value of commercial property generates 20%- 40% of tax revenues for states and localities.

As vacancies climb, the valuations of those buildings decrease, reducing the property taxes the cities collect on those buildings. Less property taxes means less revenue for the cities’ operating budgets, which fund critical services like police and fire protection, trash pickup and recycling programs and repairs and upkeep to streets, sewers and other critical infrastructure, putting those cities in a difficult bind.

Distressed Office Assets’ Impact on Surrounding Businesses

Fewer people in downtown office buildings also means fewer customers for the surrounding businesses, like restaurants, dry cleaners, coffee shops and convenience stores, which rely heavily upon office workers. Not only are many of these businesses struggling to survive, but lower sales means less sales tax revenue for cities, which also impacts their operating budgets. Research firm Pew says that of each dollar in taxes cities and counties collect, approximately 16% comes from general sales taxes.

As businesses fail, the commercial space they occupy becomes vacant, reducing its value, which further reduces the property taxes the cities collect and adds to the inventory of distressed commercial real estate assets and non-performing commercial real estate loans.

Public Transportation Suffers

Fewer workers downtown also means fewer people taking public transportation. The Congressional Research Service estimated that public transit ridership in the US in mid-2022 was only about 62% of pre-pandemic levels. Because urban public transportation systems rely heavily upon riders’ fees to fund operations—how much varies by city and mode of transportation– many big city public transportation systems still find themselves struggling to make ends meet. The federal government supplemented public transportation budgets in 2020 and 2021, but funding for the program was expected to run out in 2023.

Office to Apartment Conversions Enter the Conversation

Against this bleak backdrop, many owners of distressed office buildings are considering converting their struggling assets into apartments or mixed-use real estate. After steadily increasing for the last decade and reaching a peak of 6,874 units in 2020, the height of the pandemic, the number of office to apartment conversions counterintuitively dropped in 2022 to 3,390 units. Why the drop in multifamily conversions while office vacancies soared and the number of distressed office building and volume of non-performing commercial real estate loans steadily mounted?

The slip was primarily a result of two factors: uncertainty around whether return to office rates would eventually rise as more companies pushed their employees to start working in the office more often and distressed asset owners and would-be buyers and investors unable to agree upon valuations for the flailing buildings.

Private Equity Looks to Buy Distressed Office Assets

However, by Q1 2023, the log jam was breaking. By August 2023, commercial property values had fallen 10% to 15% from their peaks in Q3 2022 and some estimate they could end up falling a total of 20% to 25% before bottoming out. Many owners saw the handwriting on the wall and realized their office buildings might never recover fully and become solvent again, so they began converting the buildings to apartments or other uses.

Others began selling to opportunistic investors like well-capitalized private equity and investor funds that planned on upgrading the buildings or converting them to apartments to make them profitable again. According to the Wall Street Journal in August 2023, Wall Street firms including Cohen & Steers, Goldman Sachs and Invesco had amassed billions of dollars in funds earmarked for purchasing distressed office buildings and other types of commercial properties and were waiting to swoop in when the price was right.

Big Cities Encourage Multifamily Conversions

Faced with looming financial crises, and a shortage of affordable housing, some big cities have begun taking steps and enacting new programs to encourage the conversion of distressed office buildings and other types of properties to apartments.

For example, in August 2023, New York City Mayor Eric Adams and director of New York City’s planning department Dan Garodnick unveiled an ambitious plan to spur the conversion of 136 msf of vacant office space to 20,000 new homes over the next decade. The sweeping plan, which encompasses 42 city blocks in Manhattan’s Midtown South area, updates existing zoning rules to allow housing for up to 40,000 residents, including permanently affordable housing. The plan is awaiting approval by the New York City Council.

As a result, in July 2023, an estimated 122,000 new apartments were in various stages of conversion from offices and other types of buildings and were expected to be delivered in coming years. Approximately 45,000 of those units—37%– were from office conversions.

Hotel to Apartment Conversions Jump

While the number of office to apartment conversions dropped from 2021 to 2022, the number of hotel to apartment conversions increased to 2,954 from 2,060, a 43% jump. The increase was likely a delayed result of the record hotel vacancies during the height of the pandemic– in April 2020, 8 in 10 hotel rooms were vacant—and the huge financial blow that dealt to the sector. A significant drop in tourism in several popular tourism destinations, like San Franciso and China, following the pandemic also contributed to hotels’ financial woes, opening the door to more hotel to apartment conversions, especially to affordable housing.

Shopping Mall to Apartment Conversions Are on the Rise

Meanwhile, there’s also been a steady uptick in the number of shopping malls converting space to apartments. By Q1 2022, many shopping malls had fully rebounded from the impacts of the pandemic. Retail research firm Coresight Research says that from 2019 to 2022, foot traffic at top-tier malls rose by 12% and revenue grew 5% annually. During the same period, foot traffic in lower-tier malls grew by 10%, while total revenue grew by 9%.

Still, many shopping malls across the country are struggling. The Wall Street Journal said in August 2023 that the values of some malls had declined by more than 70% in recent years. Consequently, many anxious owners are now converting vacant or underperforming space in their malls into apartments. Mall to apartment conversions underway in mid-2023 included:

- The owner of the Westfield Old Orchard Mall in Skokie, IL, a suburb of Chicago, announcing plans to tear down a vacant Bloomingdale’s store and build hundreds of apartments in its place.

- New York-based commercial real estate firm Tishman Speyer’s redevelopment of the former Mazza Gallerie in Washington, DC into a mixed-use development with 320 apartment units and 90,000 sf of retail space.

- The City Council of Westminster, CA formally adopting a plan to convert the struggling Westminster Mall into a mixed-use development with up to 3,000 residential units, as many as 425 hotel rooms and at least 600,000 sf of retail space.

Uncertainty In Commercial Real Estate, Capital Markets

Many of the elements that affect commercial real estate — the office sector in particular—and the volume and type of multifamily conversions are currently in flux, including the economy, interest rates, inflation, capital markets, and demand for office and retail space, hotels and housing. With conditions likely to continue changing and shifting in the months ahead, we’re going to post updates on multifamily conversions regularly and share new information and data as they become available to help our readers stay up to date.

If you have an interest in multifamily conversions, vested or otherwise, we encourage you to check back here regularly or to subscribe to our bi-monthly newsletter, CRE News | Analysis | insights, where multifamily conversions is bound to be one of the topics we cover.

More Information on Multifamily Conversions

Meanwhile, if you’d like additional, up-to-date information on multifamily conversions, there are four insightful infographics in our Library that might interest you. They are:

Our Blog Series on Multifamily Conversions

In addition, we recently updated our earlier blog posts on multifamily conversions with new information and statistics. The topics covered are:

About the Author

Terry Banike is Realogic’s Vice President of Marketing. Over the course of his career, he has worked in marketing, communications, journalism and public relations, and has written numerous news stories and feature articles for newspapers, trade publications, newsletters and blogs. A rabid reader of anything and everything on commercial real estate, Terry closely follows commercial real estate news and trends and frequently posts about real estate on the Realogic Blog. He can be reached at tbanike@realogicinc.com.