Welcome to Part 4 in our series on multifamily conversions.

In this post, we look at converting space in vacant or struggling shopping malls into apartments—an idea that had taken root before the pandemic but was accelerated by it—including an analysis of the current state of US malls and the pros and cons of mall to apartment conversions for mall owners, developers and prospective apartment tenants.

The Pandemic Stings The Retail Sector

As with other types of properties, the pandemic helped fuel an increase in retail to multifamily conversions. Many malls and specialty retailers were already struggling due to the ongoing shift from traditional brick and mortar stores to online shopping, as well as other changes in consumers’ shopping habits. So were established department stores like Macy’s and big box retailers like Sears, traditional mall anchor tenants that drew shoppers, attracted other tenants and helped keep malls profitable for owners.

The Pandemic Accelerates the Shift to eCommerce

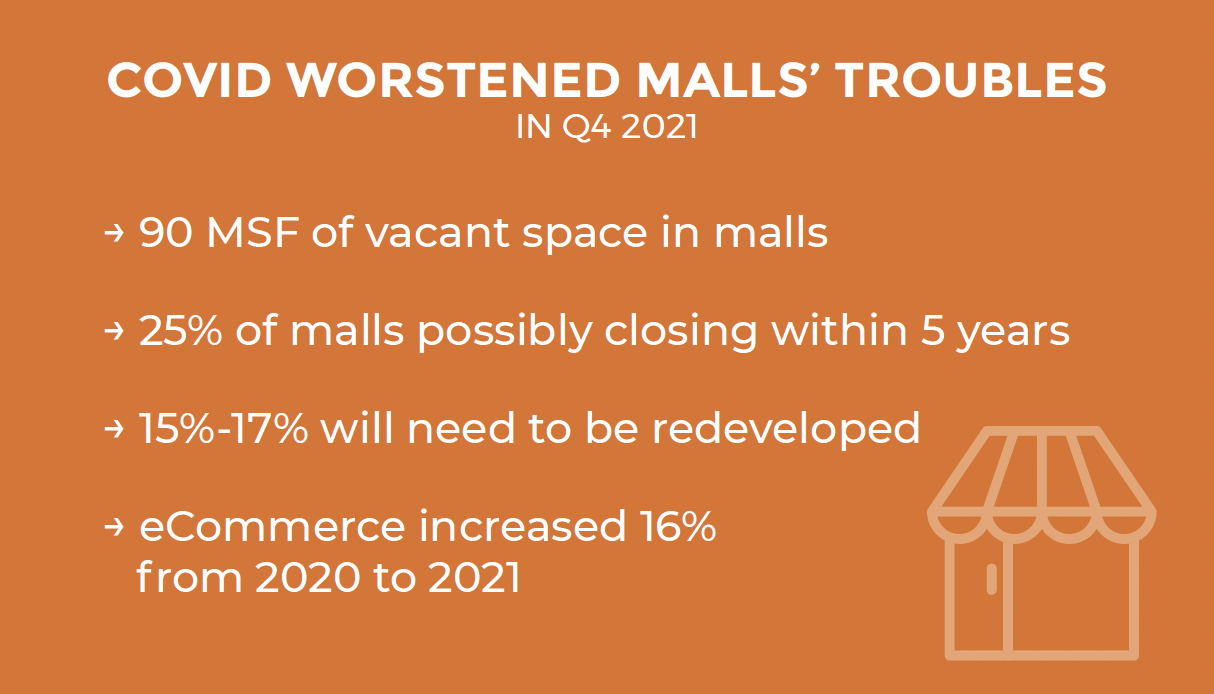

Then, the pandemic struck in early 2020, accelerating the shift to ecommerce; US Census Bureau figures show that total ecommerce sales were $612.9 billion during the first three quarters of 2021, a 16% increase from 202042.

In 2022, US eCommerce sales totaled $1.03 trillion– a 7.7% increase from 2021– surpassing the $1 trillion mark for the first time.

Retail Vacancies Spiked During the Pandemic

Adding to brick-and-mortar retail’s challenges, curbside pickup and home delivery grew in popularity too, and the lockdowns, mandates, health and safety protocols and other measures meant to curb the pandemic, as well as the fear of being in a public place and catching Covid, reduced foot traffic and in-person shopping even further, leading to a spike in retail vacancies. In 2020 and 2021, the vacancy rate for US retail properties averaged 4.9%, up 20 bps from Q3 2019, before the onset of the pandemic.

Many Shopping Malls Were Struggling Before the Pandemic

While the Covid-19 pandemic dealt a hard blow to retail real estate, including shopping malls, many malls were struggling before the pandemic.

In a sign that dire prediction wasn’t far off, in April 2022, Paris-based Unibail-Rodamco-Westfield, parent company of US mall operator Westfield, announced its intentions to exit the US market entirely by 2023.

Shopping Malls Rebound

However, by Q4 2022, the fortunes of many shopping malls had changed:

- In June 2023, Coresight reported that foot traffic in top-tier malls– malls located in affluent areas where the average annual income is $200,000+ — rose by 12% from 2019 to 2022.

- Between 2020 and 2022, revenue at top-tier malls grew by 5% annually, totaling $7.5 billion in 2022.

- While lower-tier malls lagged slightly, foot traffic was 10% higher in 2022 than in 2019 and annual revenue grew by nearly 9% from 2019 to 2022, totaling $6.4 billion in 2022.

- In Q1 2023, the vacancy rate for retail property stood at 4.2%, down 20 bps from Q1 2022 and a sizeable 70 bps drop from the 4.9% average vacancy rate in 2020 and 2021, the height of the pandemic.

The Rise of Omni-Channel Marketing

Why the big rebound for shopping malls? Retail experts credit a rise in omni-channel marketing, when a brand’s digital and physical assets complement and enhance each other to the brand’s overall benefit, a relatively recent and growing trend largely driven by Gen Z’s evolving shopping and lifestyle preferences.

Many Shopping Malls Are Still Struggling

Despite the reported uptick in overall foot traffic and revenue and drop in vacancies, many shopping malls across the US are still struggling to survive, dragged down by excess vacant space, the demise of the department store– the traditional mall anchor– the well-publicized struggles of high-profile retail tenants like Sears, Gap and Bed, Bath & Beyond and over-allocation of valuable space to parking.

The Wall Street Journal reported in August 2023 that the values of some shopping malls had declined by as much as 70% over the past few years.

For the anxious owners and operators of the many shopping malls that are struggling, the question then becomes how to resuscitate their once thriving, profitable commercial real estate assets. One alluring answer is converting space in and around their shopping malls to residences.

Converting Malls to Apartments: An Idea Whose Time Has Come

The idea of converting space in shopping malls to apartments has been picking up steam in recent years. In late January 2022, at least 192 US malls were planning on adding housing46 ; about 33 shopping malls had added apartments since the onset of the pandemic47.

In Q1 2023, many more shopping mall to apartment conversions were underway, including:

- The owner of the Westfield Old Orchard Mall in Skokie, IL, a suburb of Chicago, announced plans to tear down a vacant Bloomingdale’s store and build hundreds of apartments in its place.

- Retail REIT Kimco was converting space at its Westlake Shopping Center in Westlake, CA that was formerly a Burlington Coat Factory into a 214-unit apartment complex. Kimco plans to build a total of 400 apartments at the mall.

- New York-based commercial real estate firm Tishman Speyer’s redevelopment of the former Mazza Gallerie in Washington, DC into a mixed-use development with 320 apartment units and 90,000 square feet of retail space.

- The City Council of Westminster, CA formally adopted a plan to convert the struggling Westminster Mall into a mixed-use development with up to 3,000 residential units, as many as 425 hotel rooms and at least 600,000 square feet of retail space.

Mall to Apartment Conversions Offer the Best of Both Worlds

Mall to apartment conversions can also be a best of both worlds scenario; generally, only parts of the mall or its parking lots are converted to multifamily space. So, the higher visibility and better performing sections of the mall can remain retail space to attract and retain strong tenants and continue generating rents, while the underperforming sections can be converted to housing to generate new revenue.

The concept of adaptive reuse to multifamily also dovetails with the growing trend of converting struggling malls to de-facto community centers, where people can gather, socialize, shop, eat and be entertained.

Mall to Apartment Conversions Attract New Types of Retail Tenants

In addition, adding apartments to malls opens the door to bringing in new types of retailers whose services residents need, like grocery stores, pharmacies and healthcare clinics. It becomes a win-win for mall owners: being located so close to essential services increases the apartments’ appeal; being located so near hundreds of apartment dwellers who need their products and services increases the mall’s appeal to prospective retail tenants.

Other Types of Shopping Mall Conversions

In addition to apartments and condominiums, mall owners have been adding hotels and offices to their properties, and bringing in non-traditional tenants like ecommerce fulfillment centers, medical offices and even schools to boost sagging revenues.

Apartments in Malls Appeal to Renters

For renters, living in or adjacent to a shopping mall is appealing for several reasons. The most obvious is living in such close proximity to shopping, dining, entertainment, gyms and the other services offered by the mall, which essentially become amenities to the apartment building. It’s akin to the live/work/play dynamic that fueled demand for apartments in urban neighborhoods before the pandemic and is increasing demand again. Because many malls are centrally located, residential tenants are close to businesses and services outside the mall as well.

Another reason mall apartments appeal to renters is transportation. Shopping malls tend to be located at major intersections, providing easy egress to main roads to tenants. In addition, many malls are on public transit routes, giving apartment dwellers convenient access to public transportation.

And, with malls’ expansive parking lots and garages, parking is rarely an issue for apartment tenants.

The Downsides of Mall Living

Living in an apartment in or adjacent to a shopping mall can also have its downsides. Malls can be loud and noisy; they get crowded at times, especially during the holidays; traffic in and around malls can be heavy. And, the parking lots, signs, storefronts and surrounding roads are brightly lit at night, potentially disrupting tenants’ sleep.

The Downsides of Mall to Apartment Conversions For Developers

While converting part of a moribund mall to apartments or another use can pay dividends, converting the entire property can severely backfire, say some experts. Barclays predicts that converting an entire mall into a residential complex or e-commerce warehouse could ultimately reduce the property’s value by 60%-90%49, a staggering drop. Barclay’s research indicates that redeveloping a mall to a mixed-use property is a much better strategy for recovering the property’s value.

Additional Challenges of Converting Malls to Apartments

Other challenges mall owners need to consider are:

- Zoning: Oftentimes, the land malls are on is not zoned for residential use, so the owner and developer will have to apply to have the site re-zoned. This can be very time-consuming and costly. In addition, there’s no guarantee the local planning and zoning board and local government leaders will approve the zoning change.

- Site Plan: Likewise, the site plan for the reconfigured mall must be approved by the local governmental authorities. This too can be a lengthy and time-consuming process, and the owner and developer may need to revise the plan before it is approved, which would add to the time and expense of the project. Significant changes might reduce the profitability of the project or even make it financially unfeasible.

- Capital Requirements: In addition to construction and leasing costs, adaptive reuse of shopping malls often requires the demolition of existing structures, which is very expensive and drives up the amount of capital required for the project.

- Existing Tenants: Many malls targeted for adaptive reuse are still partially occupied by tenants with time left on their leases. Noise, traffic, dust and disruptions from demolition will likely hurt their business; some tenants may be located in a portion of the mall that’s going to be converted. Consequently, the mall’s owner needs to figure out what to do with any retail tenants who might be adversely impacted by the conversion.

- Differences Between Retail and Multifamily: While there are some similarities between the two property sectors, they’re also very different in many ways and have very different dynamics. Multifamily generally involves more tenants with shorter leases than retail, and apartment tenants tend to be more transient, with higher turnover.

Also, retail leases and leasing tend to be more complicated than multifamily leases and leasing. For that reason, it’s best mall owners looking to add apartments to a property partner with someone with multifamily expertise, if they don’t already have that expertise within their organization.

- Multiple Owners: Sometimes, different sections of a mall have different owners. The core retail area may have one owner; a big box anchor tenant, like a department store, may own its own space; the parking areas may be owned by a third company; the out lots may be owned by a different party or parties altogether. In these mixed ownership scenarios, any plans to convert part of the mall to apartments will need to be approved by and coordinated between all parties involved, as specified in everyone’s legal agreements, which can complicate the project significantly and add to its length and cost.

Next, Chapter 5: Department Stores and Other Types of Multifamily Conversions

Next, the fifth chapter in our series on multifamily conversions, on how old department stores and other types of vacant and obsolete properties are being repurposed into new apartments.

In case you missed the previous posts in our series, the topics we covered were:

- The history of multifamily conversions and the dynamics behind their current surge in popularity

- Office to apartment conversions

- Factory and hotel conversions

About The Author

Terry Banike is Realogic’s Vice President of Marketing. Over the course of his career, he has worked in marketing, communications, journalism and public relations, and has written numerous news stories and feature articles for newspapers, trade publications, newsletters and blogs. A rabid reader of anything and everything on commercial real estate, Terry closely follows commercial real estate news and trends and frequently posts about real estate on the Realogic Blog. He can be reached at tbanike@realogicinc.com.