Editor’s Note: We recently updated this post on Gross Up in Commercial Real Estate from 2016, adding new information, expert insights and supporting examples, as well as links to additional resources. To read the updated version of the post on Gross Up, click here.

Editor’s Note: We recently updated this post on Gross Up in Commercial Real Estate from 2016, adding new information, expert insights and supporting examples, as well as links to additional resources. To read the updated version of the post on Gross Up, click here.

Following up on the previous post about Caps on Operating Expenses, today’s post is all abut the often misunderstood concept called Grossing Up or simply Gross Up. The Gross-Up of operating expenses is a critical mechanism that allows landlords to equitably allocate operating expenses that are variable in nature. Specifically, the operating expenses that vary as a result of occupancy are increased to an amount that have been incurred if a defined level of occupancy were achieved.

In a typical gross-up scenario, the level to which a landlord may artificially increase variable expenses due to a gross-up clause is 95% or 100% (also known as full occupancy).

While this may seem like an unfair method for the landlord to artificially inflate expenses and overcharge a tenant, the goal of a well drafted gross up clause is to protect both parties from dramatic swings in recoverable operating expenses.

Gross Up – Illustrated

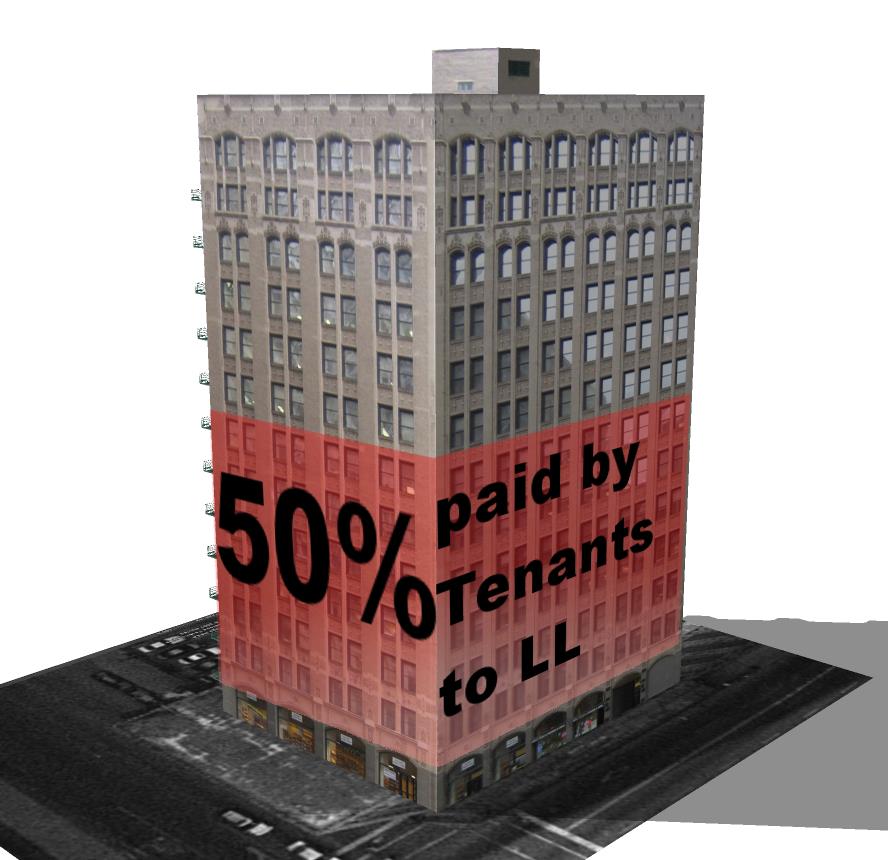

Imagine a building with one tenant occupying 50% of the building. The Landlord pays $100,000 in Variable Expenses (such as Janitorial Services). Now, only the occupied portion of the building receives the services which make up Variable Expenses.

If the one tenant paid their pro rata share of operating expenses, they would only be responsible for $50,000 of the cost, despite being the sole tenant.

Now, that doesn’t seem fair, does it?

That’s why the gross-up clause often will take any occupancy below 95% as if the building were 95% occupied (or fully occupied, as the lease may read).

In our example, the one tenant occupying 50% of the building would pay $95,000 (representing the 95%) while the landlord would absorb the remaining $5,000.

For more elaborate examples of gross-up, grab the brief e-book beneath this post. Be sure to return to the Realogic blog again next week where we’ll discuss the retail-specific additional rent known as Percentage Rent.