Another lease-related topic that generates a lot of interest is percentage rent. That’s been especially true the last two or three years, as changing consumer shopping habits have shaken up the retail industry and, by association, retail real estate. For those unfamiliar with the concept, percentage rent is a type of rent primarily found in retail leases where the tenant pays the landlord a percentage of the gross sales generated from the space being leased. Oftentimes, but not all the time, the tenant doesn’t start paying percentage rent until gross sales from the location surpass a specific threshold called a Breakpoint. A tenant might pay percentage rent instead of or in addition to Base or Minimum Rent. Percentage rent is used to some degree in almost all retail categories.

By the way, in case any of the terms above are unfamiliar to you, there’s a handy glossary of commercial real estate lease terms in our Library you can download.

A Win-Win For Tenants and Landlords

Percentage rent benefits both landlords and tenants. Tenants benefit because percentage rent encourages the landlord to actively maintain and promote the property to help increase the tenant’s gross sales, which in turn increases the amount of rent the landlord collects, allowing them to share in the tenant’s success and maximize rents from the property. Percentage rent protects the tenant by keeping rent proportional to the sales generated by that location. If sales for the location drop or fall short of expectations, as happened to many retailers during the COVID pandemic, the tenant’s rent will adjust accordingly, helping them survive downturns.

More About Percentage Rents and Breakpoints

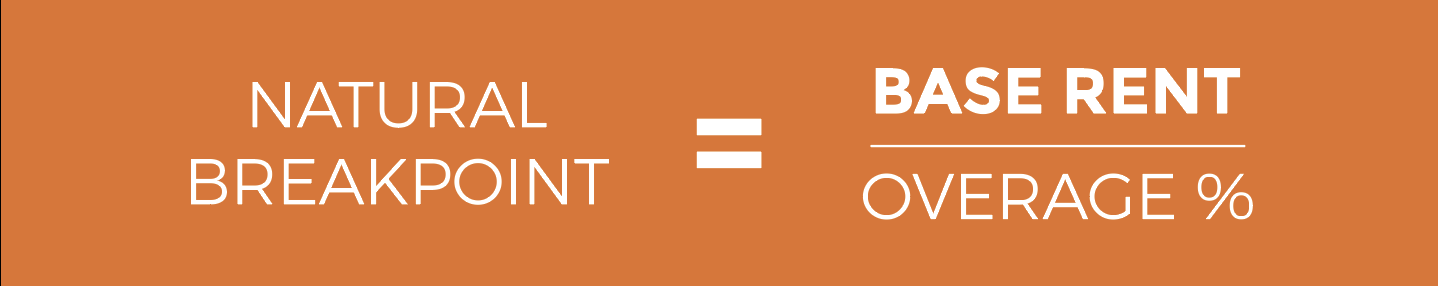

As explained above, a Breakpoint is a threshold or trigger that determines when a tenant starts paying percentage rent. Breakpoints are based on the gross sales from the premises, and there are two types: natural or fixed dollar. Natural breakpoints are calculated using an Overage Percentage, which is the percentage of gross sales over a set dollar amount that the tenant is required to pay in rent. When a natural breakpoint is used to calculate percentage rent, the Overage Percentage is always stated in the lease, as is the Base Rent. The formula to calculate the Natural Breakpoint is:

A Fixed Dollar Breakpoint, on the other hand, is stated in the lease as a straight percentage, of either total Gross Sales or Gross Sales per square foot. A Fixed Dollar Breakpoint is determined as part of lease negotiations between the landlord and tenant.

Percentage Rent, Illustrated

The concept of Percentage Rent is fairly straightforward, but can be tricky initially for anyone who hasn’t encountered it before. Here’s a quick, step-by-step example of how to calculate Percentage Rent using a Natural Breakpoint:

Scenario:

- Retail Tenant A signs a 10-year lease for a 10,000 square foot space in Realogic Mall, a Class A strip mall located in a Chicago suburb.

- Tenant A’s lease states that in addition to its Base Rent, it is obligated to pay Percentage Rent of 5% of its gross sales over a Natural Breakpoint.

- Tenant A’s Base Rent is $12,000 per year.

1. The first step in calculating Tenant A’s Percentage Rent is to calculate the Natural Breakpoint.

Using the formula above, the Natural Breakpoint would be calculated as follows:

Base Rent ($12,000) ÷ Overage Percentage (0.05) = Natural Breakpoint ($240,000)

So, in addition to $12,000 in annual Base Rent, Tenant A will pay the landlord 5% of all gross sales exceeding $240,000 per year– the Natural Breakpoint.

2. The second step then, is to verify the gross sales for the leased premises for the full year.

Generally, there are provisions in the lease for verifying gross sales. In this case, let’s say Tenant A’s lease stipulates that it shall submit monthly gross sales reports to the landlord, as well as an end-of-year report showing gross sales for the full year. The reports confirm that gross sales for the premises for the full year were $425.000.

3. The third step is to subtract the Natural Breakpoint from total Gross Sales to determine the Dollar Overage that is subject to Percentage Rent. In this case:

Gross Sales ($425,000) – Natural Breakpoint ($240,000) = Dollar Overage ($185,000)

Finally, multiply the Dollar Overage by the Overage Percentage stated in the lease:

Dollar Overage ($185,000) x Percentage Overage (.05) = Percentage Rent ($9,250)

So, Tenant A owes the landlord $9,250 in Percentage Rent for the first year of its lease.

The Click and Collect Debate: Include In Gross Sales or Not?

The popularity of so-called Click and Collect purchases, where a consumer buys something online through a company’s web site but picks it up at a physical store rather than having it shipped, has soared in recent years, driven by both changing consumer shopping habits and the COVID pandemic. In the first quarter of 2020, about 1/3rd of US consumers made a Click and Collect purchase, up from 28% in Q1 of 2019. Naturally, with Click and Collect purchases accounting for a growing percentage of retailers’ sales, landlords want them included in Gross Sales figures used for Percentage Rent calculations. Tenants of course do not because higher Gross Sales translate to higher rent. Landlords are increasingly using the point as a bargaining chip, agreeing to shorter-term leases or to restructure leases in exchange for retailers including Click and Collect or even full omni-channel sales in their Gross Sales figures for Percentage Rent. In fairness to retail tenants, if Click and Collect sales are to be included in Gross Sales, then returns and exchanges of those purchases should be factored in too. Some retail tenants are coaxing generous concessions from landlords in exchange for including online or mobile sales in Gross Sales, including the option to terminate a lease if sales at a location drop below a certain threshold for a certain period of time. The debate over whether receipts from Click and Collect and omni-channel purchases should be included in Base Rent is bound to continue as the number and dollar amount of Click and Collect, online and mobile purchases made by consumers continues to rise.1

A Few Additional Notes on Percentage Rent in Commercial Real Estate

- Anytime Base Rent changes, so does the Natural Breakpoint.

- If a tenant is paying percentage rent using a fixed dollar or dollar per square foot breakpoint, rather than a Natural Breakpoint, those breakpoints will be specified in the tenant’s lease.

- Breakpoints can be cumulative and payment periods can vary. Both are typically addressed in the lease.

- Landlords may be entitled to recapture expense recoveries against percentage rent. If so, it will be stated in the lease.

- Breakpoints can be tiered, so the overage percentage changes as sales increase.

- Certain goods and services may be excluded from Gross Sales tabulations. In addition, different categories of goods and services may have different Overage Percentages. For example, a convenience store may have a different Overage Percentage and thus a different Percentage Rent for food as opposed to lottery tickets or magazines

Additional Resources and Information on Percentage Rent and Leases

If you’d like to learn more about Percentage Rent or commercial real estate leases in general, we’ve updated several of the more popular blog posts from our series on Commercial Real Estate Lease Fundamentals. The topics covered include:

If you have a specific question about Percentage Rent or commercial real estate leases that our blog posts or other resources don’t answer, feel free to email us at info@realogicinc.com.

By Terry Banike, Marketing Manager, Realogic