One topic that draws a lot of interest on both the Realogic Blog and in our commercial real estate training classes is rent increases tied to the CPI, the US government’s Consumer Price Index. What is the CPI, what does it have to do with commercial real estate and what are some important things to know about the relationship between the two? We’re happy to answer those pressing questions and more.

What Exactly is the CPI?

For those who are unfamiliar with the CPI, it’s a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. CPI is commonly used to measure and track inflation. CPI data is available for the entire U.S. as well as for many specific geographic areas within the US.1

The CPI is generated and published by the US Bureau of Labor Statistics, a department of the US Department of Labor. In addition to the broader CPI indexes, the BLS also publishes average price data for select utility, automotive fuel and food items.

Traditionally, the CPI weighting system was based upon two years of spending data and the weights were updated every two years. However, in May 2022, the BLS announced it would start using one year of spending data and update the weights every year. The changes, which went into effect with the January 2023 CPI indexes, reduce the average lag between when consumers make purchases and when the BLS uses that data to calculate the CPI from 36 to 24 months.2

CPI indexes can vary by:

- Location (national average vs. regional index)

- Type of consumer (all urban consumers vs. wage earners and clerical workers)

- Goods and services included (all items vs. specifically defined goods and services)

- Base index period (the starting point for measurement of the index, stated as 100.0).

You can learn more about CPI and the US Bureau of Labor Statistics at U.S. Bureau of Labor Statistics (bls.gov)

How CPI Impacts Commercial Real Estate

In some commercial real estate leases, CPI is used as a means to reasonably increase or decrease a tenant’s rent by tying their base or additional rent to fluctuations in the national or regional CPI, essentially tying rent to national or regional inflation. Although the practice of tying rent to the CPI is not very common, it does happen, especially in government leases. So, it’s good for commercial real estate professionals to understand the basic concept and be able to find the latest CPI data and calculate how the correct CPI impacts rent, in case they ever do encounter a CPI clause in a lease.

Rent Increases and CPI: An Example

To illustrate how rent can be tied to the CPI in commercial real estate leases, and show you how to calculate the impact of CPI on rent, we’ll use the following example:

- Tenant A signs a 10-year lease for 10,000 square feet of office space in Realogic Tower, a Class A trophy asset located in downtown Chicago.

- Tenant A’s initial Base Rent is $20,000 per month.

- The lease commences on December 1, 2023.

- There’s a clause in the lease stipulating that on December 1st of every following year of the lease agreement, Tenant A’s initial base rent will increase by the same percentage that the US CPI increases over the Base Index that is published immediately prior to the commencement of the lease.

- The CPI Base Index that will be used is CPI-U, All Urban Consumers, U.S. City Average, 1982/84=100

In order to accurately calculate the annual increase in Tenant A’s annual Base Rent, we’ll need to use the CPI tables on the US Bureau of Labor Statistic’s web site, which can be found at https://data.bls.gov/cgi-bin/surveymost?cu

Most commercial real estate leases reference the Index published immediately prior to a particular critical date, such as the date the lease commences, as in our example. There’s generally a two-month lag time in the publication of CPI tables. So, in our example, if the commencement date for Tenant A’s lease is December 1, 2023, we would use the data in the CPI table published on October 1, 2023 – the last table published before the commencement date– as the Base Line for calculating future base rent increases.

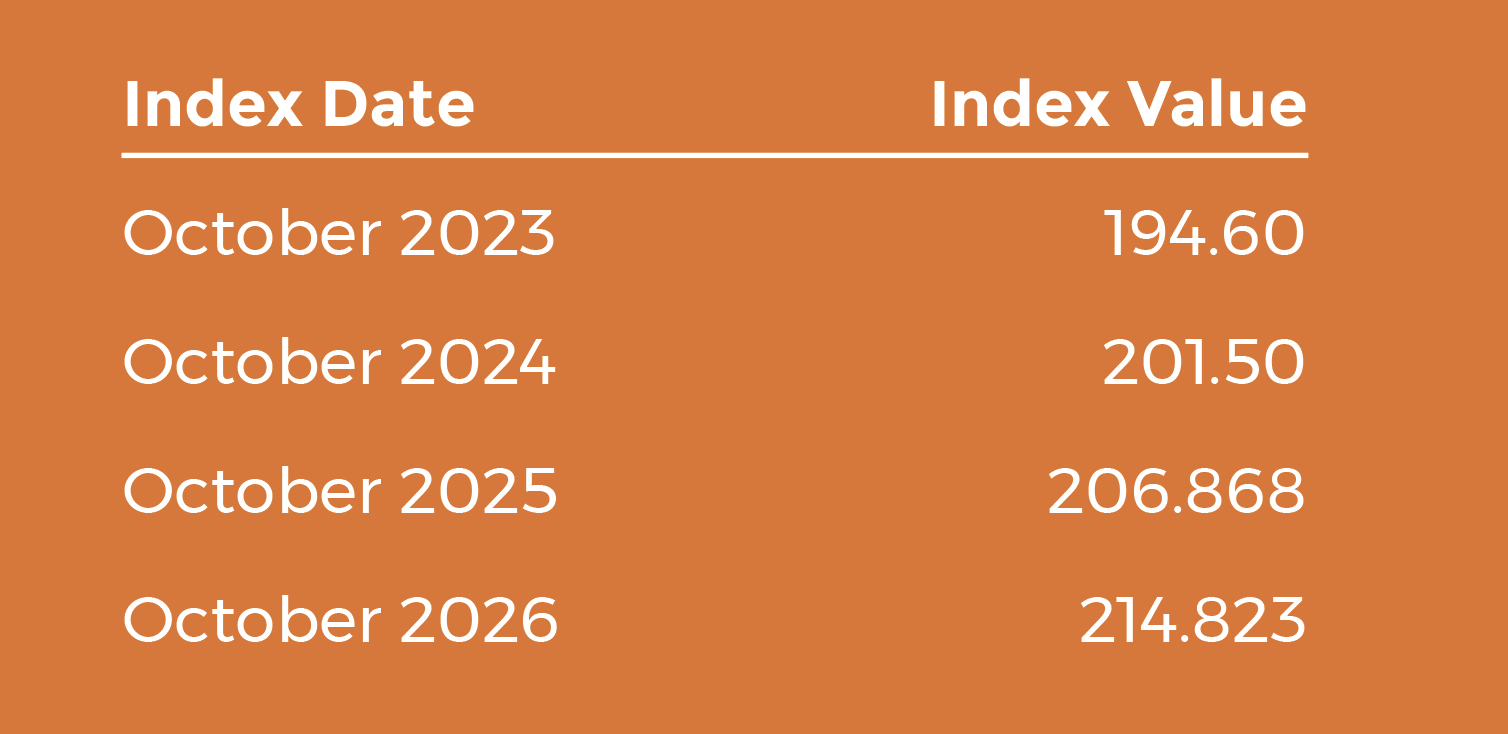

Then, here are some hypothetical yet realistic future index values we can use to complete our example and calculate Tenant A’s base rent increases for the first four years of its lease:

Tenant A’s initial base rent increase will occur on December 1, 2024. To calculate that increase, you would subtract 194.60 (the Base Index value) from 201.50, the October 2024 Current Index, which is the last Index value published before the scheduled rent increase on December 1, 2024. The difference is then divided by the Base Index of 194.60 to determine the Index Adjustment Multiplier of 3.55%

Next, multiply the Index Adjustment Multiplier- +3.55%- against the initial base rent- $20,000 per month.

In Year 2 of their lease agreement, Tenant A’s Base Rent will increase by $709.15 per month, or 3.55% of their initial Base Rent.

Here’s a simple formula that sums up the above process:

To calculate subsequent Base Rent increases, you’d follow the same process, but use the last CPI data published before each scheduled rent increase, so the Index published in October 2025, October 2026 and so on.

Some Additional Notes on CPI in Commercial Real Estate

Be aware that:

- Not all leases with CPI increases bump each lease year

- Some leases may have calendar year or mid-term increases

- Some leases may have caps or floors on the CPI increase

- The amount of CPI adjustment is unknown at lease commencement, so it is often disregarded in the calculation of leasing commissions.

Also, most leases nowadays use fixed rent steps, such as a flat percentage increase per year, or dollar per square foot increase per year, as opposed to CPI adjustments. This reduces the amount of time and effort needed to calculate rent adjustments and helps eliminate potentially costly mistakes.

Additional Resources and Information on Commercial Real Estate Leases

If you’d like to learn more about commercial real estate leases, we’ve updated some of the most popular posts from our series on Commercial Lease Fundamentals. The topics include:

In addition, there are several resources in our Library you might be interested in, such as The ABCs of Commercial Real Estate Leases—A Comprehensive Guide, and our Glossary of Commercial Real Estate Lease Terms, with definitions to 140+ terms.

Finally, Realogic offers a training class entitled “Understanding Commercial Real Estate Leases” that covers all the basics and then some, as well as a class on abstracting leases. You can learn more about all of our training classes on the CRE Training page of our website.

1,2 US Bureau of Labor Statistics Web Site; CPI Home : U.S. Bureau of Labor Statistics (bls.gov)

By Terry Banike, Vice President of Marketing, Realogic