Expense Gross Ups—or Grossing Up– is a term that frequently appears in commercial real estate leases. Grossing Up is a process for calculating a tenant’s share of a building’s variable operating expenses, where the expenses are increased for expense recovery purposes, or Grossed Up, to what they would be if the building’s occupancy remained at a specific level, typically 95%- 100%. Expense gross ups allow property owners and lenders to minimize their financial exposure to vacancy rates as they rise and fall.

Gross Ups In Commercial Real Estate, Explained

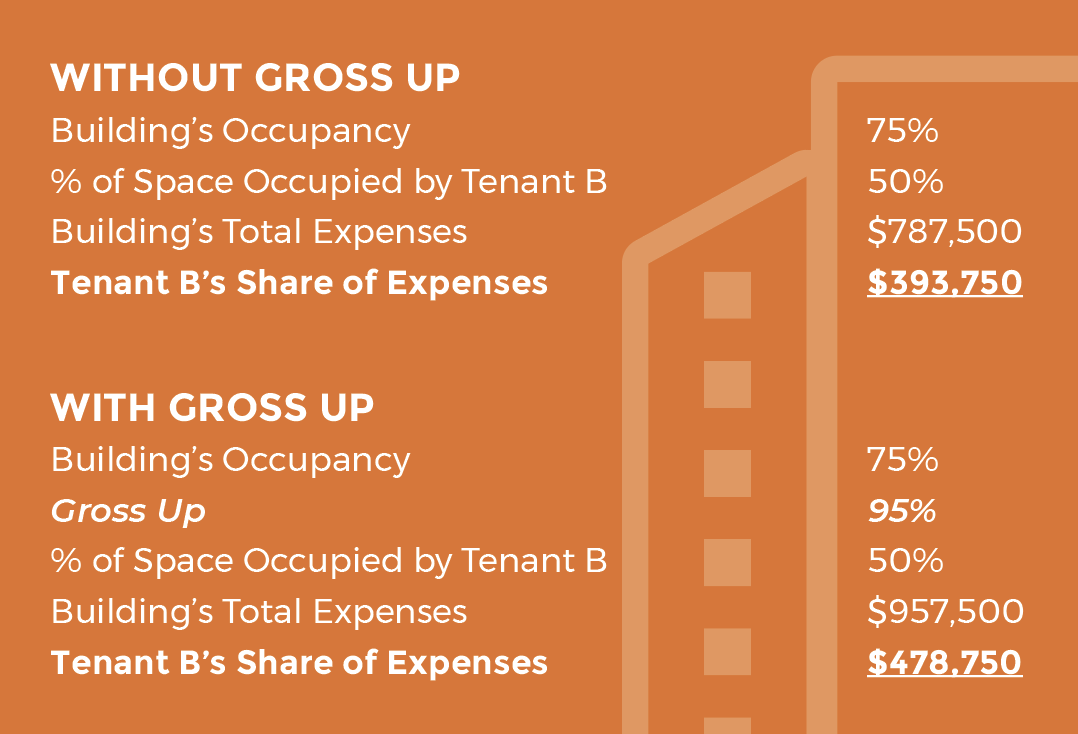

To better understand the concept of Gross Ups and how they work, consider the following example:

- Landlord A owns and manages Realogic Tower, a Class A office building located in Chicago’s Central Business District.

- Landlord A pays $1,000,000 in operating expenses for Realogic Tower annually when the building is 100% occupied. 85% of those expenses are variable and 15% are fixed. $850,000 and $150,000 respectively.

- However, to understand how gross ups work, let’s assume that the building is actually 75% leased and includes a tenant, Tenant B, who occupies 50% of the building.

- The first step is to determine the actual variable expense pool when the building is 75% occupied ($850,000 x 75%). This results in a subtotal of $637,500. The fixed portion of the building’s expenses remain $150,000.

- Under a simple Pro Rata division of expenses, since Tenant B occupies 50% of Realogic Tower, Tenant B would be responsible for 50% of the building’s fixed and variable operating expenses, or $393,750 (50% X $150,000 fixed expenses + 50% X $637,500 variable expenses).

- Now, let’s say that Realogic Towers leases allows Landlord A to Gross Up variable expenses as if Realogic Tower were 95% occupied instead of only 75% occupied.

- In this scenario, the building’s tenants would be responsible for their share of variable operating expenses as if the building was 95% occupied ($850,000 x 95%). This results in a subtotal of $807,500.

- Under a simple Pro Rata division of expenses when the building is grossed up to 95%, Tenant B will be responsible for $478,750 (50% x $150,000 fixed expenses + 50% x $807,500 variable expenses grossed up to 95%).

- As you can see, Grossing Up variable expenses provides cost certainty to the landlord regardless of the building’s actual occupancy rate because the building’s tenants are the ones benefitting from the support and services that are generated by the variable operating expenses, not the landlord. Thus, it’s only fair that the tenants pay for most of the cost.

More On The Subject of Rent and Recoverable Expenses

Commercial real estate leases can be very lengthy, complex and, at points, confusing, especially if you’re new or relatively new to the commercial real estate industry, or just don’t have much experience working with commercial real estate leases. To help our readers understand leases better, we’ve updated some of the blog posts from our popular series, Commercial Lease Fundamentals. The topics covered include:

To read one of our updated posts, just click on the link above.

In addition, Realogic offers several training courses on commercial real estate leases, including Understanding Commercial Real Estate Leases and lease abstraction. Both are taught by members of our best-in-class commercial real estate consulting team who are experts on commercial real estate leases.

You also might be interested in two very popular resources in our Library: The ABCs of Commercial Real Estate Leases, our comprehensive primer on leases, and our Glossary of Commercial Real Estate Lease Terms, which has the definitions to over 140 terms.

By Terry Banike, Marketing Manager, Realogic