This is the third and final installment in our series on The Convergence of Crystallized Promote, Commercial Real Estate and Opportunity Zones. In this post, we’ll discuss the pivotal role financial modeling plays in crystallized promote and Opportunity Zone development, investment and funds and share some financial modeling best practices.

In case you missed either of the previous installments, in the first we explained what crystallized promote is, how it works and how it is increasingly being used in commercial real estate and to facilitate Opportunity Zone development and investment.

In the second, we discussed the upsides and downsides of utilizing crystallized promote for commercial real estate and Opportunity Zone projects.

Commercial Real Estate Financial Modeling and Crystallized Promote

One of the keys to making crystallized promote work for an Opportunity Zone project or fund is skilled financial modeling. Financial modeling comes into play throughout the property’s lifecycle and repeatedly during the carried interest crystallization process, so it’s essential that all modeling is accurate and thorough and the data generated is reliable and trustworthy.

First, as with any process, it’s essential to start with a strong and stable foundation. For Opportunity Zone projects, this means the original development model must be well constructed, because if there are problems with the development model, they will impact the entire project downstream, including the promote crystallization calculations.

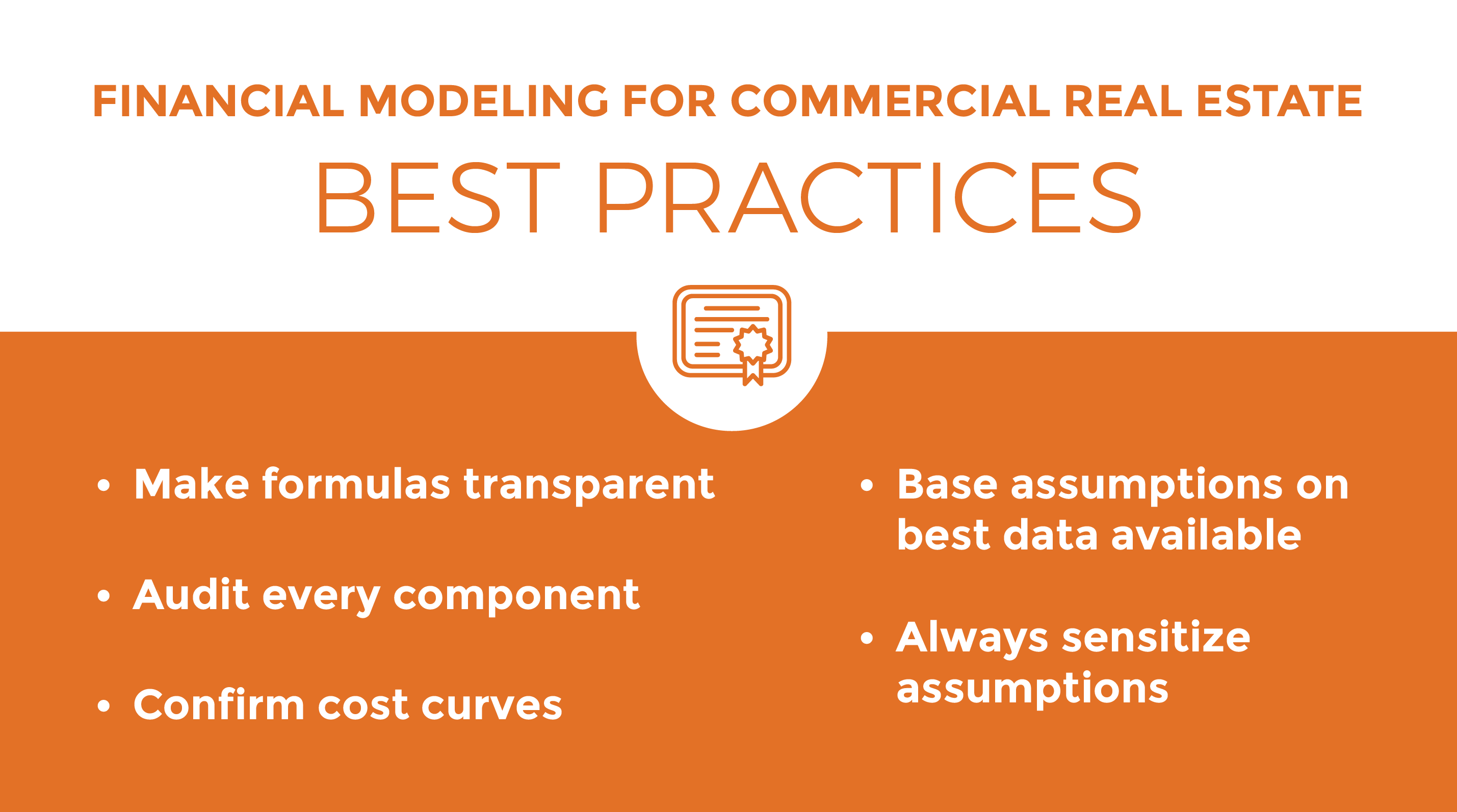

Best Practices For Financial Modeling For Commercial Real Estate

Based on our 30 years of experience modeling commercial real estate development projects, the model’s formulas should be transparent so it’s plain to see how numbers were calculated. All components, from the rent roll and debt and timing elements to debt and equity waterfall calculations, should be meticulously audited to check for errors or missing data, which can have a domino effect and completely throw off the outcomes. Cost curves should be confirmed, especially if they’re customized. Assumptions should be based on the best available data, then sensitized to show an array of possible outcomes.

Equity Waterfall Models For Commercial Real Estate

Then, the underlying equity waterfall model for the partnership must be modeled well. The initial model should accurately reflect the project’s projected returns so partners are not misled and the investment opportunity is not misrepresented.

In addition, when it comes time to calculate the crystallized promote, the building’s estimated fair market value will be run through the same model again. So, if there are problems with the model’s structure or the data in it, the numbers for the promote and ownership share adjustment might be skewed, unfairly shorting at least one of the partners.

The sponsor’s, developer’s and each investor’s hurdles and projected returns should be triple checked. If the sponsor is even remotely considering carried interest crystallization, it should be included in the initial waterfall model. Or, waterfall calculations can be modeled two ways initially, with crystallized promote and without, to show potential partners both potential outcomes upfront. If no one on your team has ever modeled crystallized promote before or audited models that include it, it’s best to get expert help from an experienced commercial real estate consultant or contractor.

Commercial Real Estate Valuation Model

Then, there’s the valuation model that might be used to determine the fair market value of the opportunity zone property at the point the promoted interest is crystallized.

When crystallized promote is utilized, and the agreed upon valuation of the building is run through the original equity waterfall model, the results should be thoroughly audited because the promote will be calculated based upon those numbers, and everyone’s share of the building’s revenue and expenses will be adjusted accordingly. If there were any errors in the original model or supporting data, this is the last best chance to catch them. Otherwise, the errors will manifest themselves in the updated waterfall model and the promote numbers. One of the best ways to catch errors in real estate financial models is by auditing them against the multitude of detailed reports that Excel and the leading DCF software platforms can generate.

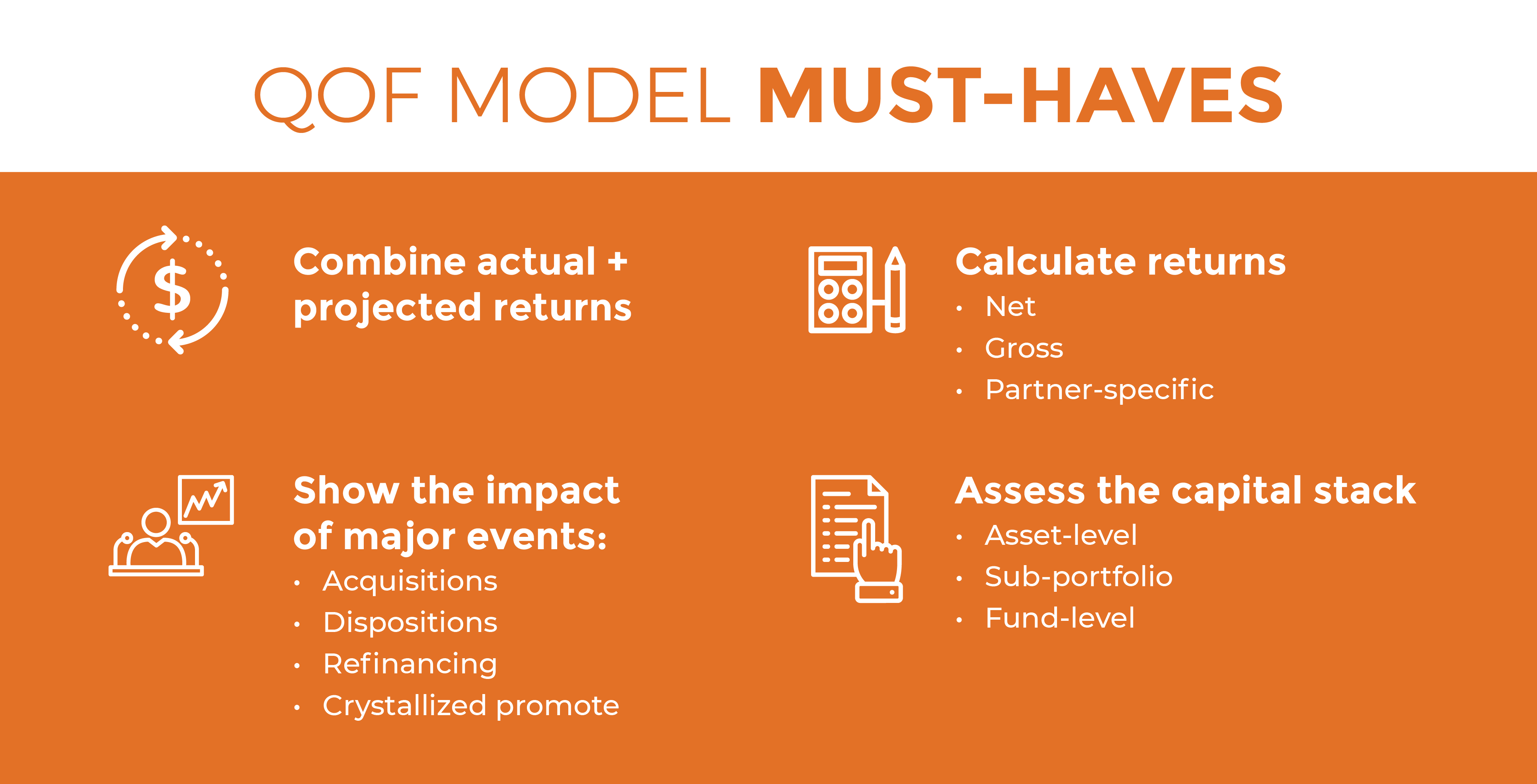

Financial Modeling and Qualified Opportunity Zone Funds

Finally, sound financial modeling is essential at the fund level too. A good QOF model should have the flexibility to combine actual and projected returns, and show the impact on the fund of individual property acquisitions and dispositions and major events like promote crystallization and refinancing. A good QOF model also should have the functionality to calculate Net, Gross and partner-specific returns from the fund, as well as to assess the capital stack at the asset, sub-portfolio and fund level. Having access to that level of detail will help fund and asset managers maximize the returns on the assets they manage, and will give investors greater visibility into the fund, boosting their confidence in the fund and potentially spurring additional investment. Anything less from your fund models, and you should consider updating or even completely rebuilding them. Or, to completely eliminate the work and guesswork, you can outsource the fund component of your modeling to a commercial real estate consultant that has extensive experience with Opportunity Zones and financial modeling, or use a pre-built Excel model created by an expert in real estate financial modeling.

A Win-Win-Win

In sum, based on Realogic’s extensive and ongoing work with Qualified Opportunity Zone projects, we’re seeing Opportunity Zones and promote crystallization increasingly intertwined. Given the requirement that a property in a QOZ must be held for a minimum of 10 years in order for the owner or owners to receive the full tax breaks from the federal program, promote crystallization is a sensible way to bridge competing objectives of QOZ project sponsors, developers and investors. Developers can receive their reward for delivering and stabilizing the building without having to wait the full 10 years or for a capital event and can move on to their next project. At the same time, the partnership retains ownership of the property for the full term, so investors who invested in the Opportunity Zone project primarily for the capital gains tax breaks receive the benefits they sought.

Because there are so many details involved in crystallized promote, and often many parties participating in the partnership or fund, it’s wise to lay out the terms for the entire crystallized promote process in detail in the partnership agreement to avoid disagreements when the time comes to execute.

In addition, Opportunity Zone property valuations, equity waterfall models and opportunity term sheets should include scenarios where crystallized promote is used, so everyone involved in the project knows it will be considered and understands the financial impact upfront.

Done right, crystallized promote can be a win-win for Opportunity Zone developers, investors and funds. And, by eliminating or reducing potential barriers to investment and development in Opportunity Zones, those who live or work in Opportunity Zones win too. A commercial real estate deal where everyone involved benefits. How can you not like that?

About The Authors

This post was a collaboration between multiple members of Realogic’s commercial real estate consulting and marketing teams, with each contributing their unique perspective, experience and specialized expertise. We welcome your comments, questions and feedback. You can reach us at info@realogicinc.com