In Part 1 of our series on The Convergence of Promote Crystallization, Commercial Real Estate and Opportunity Zones, we explained what crystallized promote is, how it works and how it is increasingly being used in commercial real estate and for Opportunity Zone development and investment.

In Part 2, we’re going to discuss the upsides and downsides of utilizing promote crystallization for commercial real estate and Opportunity Zone projects.

The Benefits of Crystallized Promote For Opportunity Zone Developers and Investors

The most obvious benefit of crystallized promote is to QOZ developers– that the developer receives its promote sooner than if it had to wait for the building to be sold or another capital event, like a refinancing. By returning its capital sooner, the developer can pursue new projects earlier, whether in a Qualified Opportunity Zone or elsewhere.

In the current uncertain economic environment, capital markets are tight and are expected to remain so for the foreseeable future, so access to affordable working capital has become even more critical to commercial real estate developers.

Another benefit of promote crystallization for the developer is the developer doesn’t have to wait until everyone else in the capital stack receives their payout to receive its promote. The longer the wait and the more investors to pay out, the greater the chances the building’s value decreases or the developer’s financial obligations increase, reducing the developer’s net promote.

Qualified Opportunity Zone investors can benefit from carried interest crystallization too. Because the partnership fulfills its financial obligation to the developer, but still holds the property for the full required 10-year term, the project’s investors receive all the tax benefits they’re entitled to, the reduction or deferment of capital gains taxes likely being the main reason they invested in the project.

The Benefits of Crystallized Promote to Opportunity Zone Funds

For many Qualified Opportunity Zone Funds, or QOFs, crystallized carried interest is now a standard component of many fund deal structures. Crystallized promote scenarios are often included in QOZ property models and in term sheets shown to prospective developers and investors. This communicates upfront that the sponsor intends to crystalize the promoted interest at some point in the project’s lifecycle and shows the financial impact on the project’s short and long-term returns.

Prospective developers and investors, in turn, can assess a project upfront and more comprehensively and make more informed decisions about which QOZ projects to participate in. QOFs, in turn, can attract the right partners and save themselves the time and trouble of having to recalibrate the deal later to include carried interest crystallization, and deal with potential fallout from investors who were not expecting a crystallized promote scenario.

Qualified Opportunity Zone Funds also can use crystallized promote to attract and bargain with new developers and investors as the fund grows and new deals are added.

Building Promote Crystallization Into Real Estate Financial Models

Take, for instance, one of Realogic’s current and most successful QOF clients. When we built their initial Excel development and fund models, we included promote crystallization functionality. They assess each deal individually and decide whether to include crystallized carried interest, depending on the nature and objectives of the deal, as well as the parties they are pitching and the parties’ objectives.

If they decide crystallized promote is warranted, the functionality is already built into their models so all they have to do is plug in the numbers and make adjustments as needed. This saves them a considerable amount of work and time because they don’t have to start over with each model or build in crystallized promote functionality each time they are considering it.

Plus, because the models are tested and proven, our client has complete confidence in the accuracy of their numbers, as do the developers and investors they work with regularly.

Crystallized Promote, Opportunity Zones and The Impact of Covid

Another valuable benefit of crystallized promote for Qualified Opportunity Zone developers that arose during the Covid-19 pandemic but is just as relevant today is that crystallized promote helps mitigate the long-term financial risks inherent in any QOZ project, especially in a turbulent and uncertain economy.

Although the pandemic has waned, its onset triggered a level of uncertainty around nearly every sector and aspect of commercial real estate, including future rents, occupancy rates, valuations and previously projected returns– especially for office buildings– that continues today.

As a result, many QOZ sponsors and developers are looking to earn their promote in the short term rather than wait the full 10-year hold and gamble that the property’s value will appreciate according to the original equity waterfall model.

The Potential Downsides of Crystallized Promote

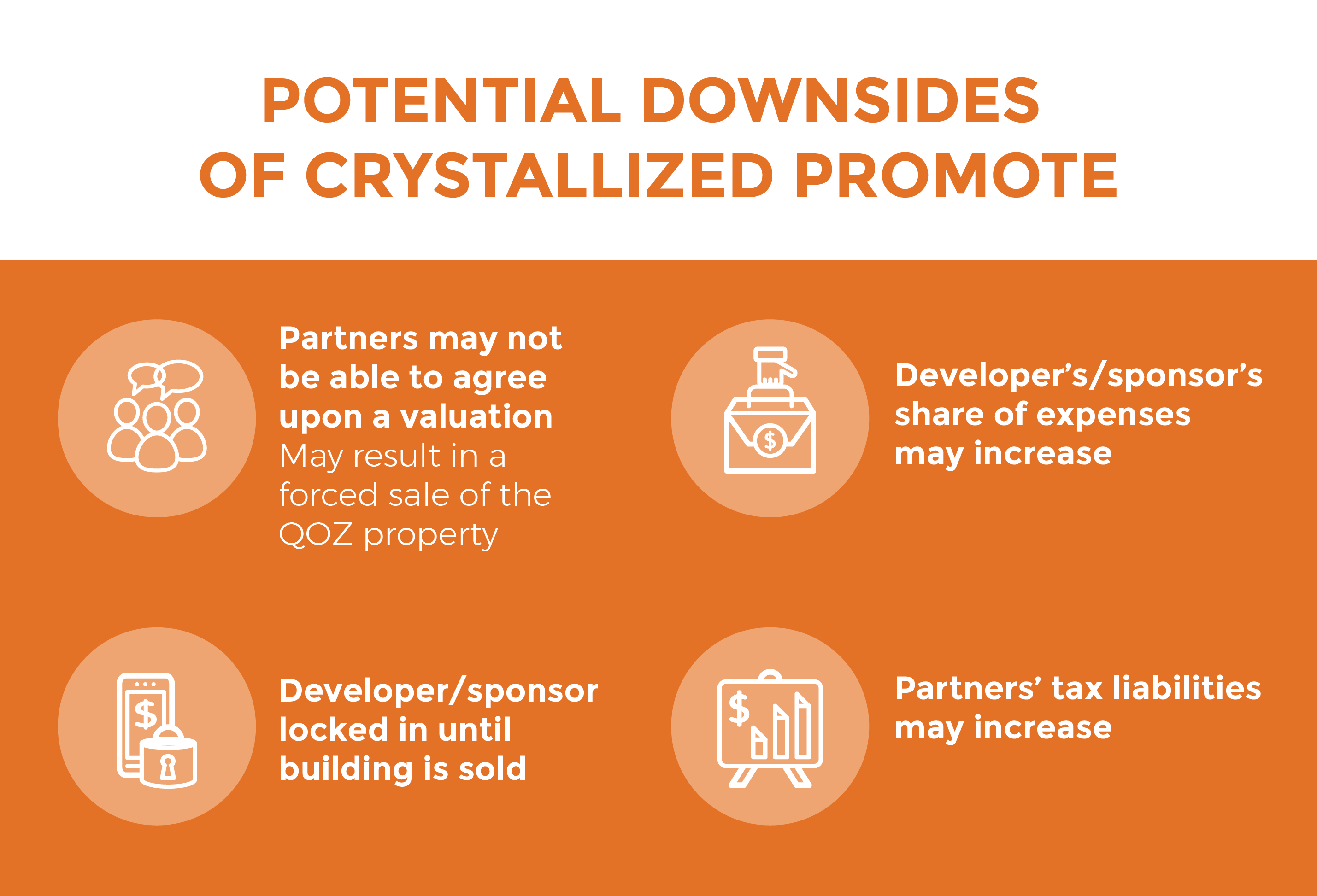

As with any complex financial transaction involving multiple parties, promote crystallization has some potential downsides for QOZ developers, investors and funds as well, the biggest being coming up with a valuation for the property that all parties can agree upon.

Even when a property is modeled by an experienced and neutral third party, like a commercial real estate consultant, or appraised by a reputable and neutral commercial real estate appraiser, disputes over the hypothetical sales price used to calculate the promote can still arise and, depending on how strongly everyone disagrees, could lead to a forced sale of the property and dissolution of the partnership before everyone’s investment goals are met, negating the benefits of the project.

Bound To The Commercial Real Estate Partnership

Unless specified in the terms of the partnership agreement, once the carried interest is crystallized, the Developer or Sponsor may not be able to initiate an exit from the partnership later, essentially locking it into the project until the building is sold or refinanced. Depending upon how long the partnership intends to hold the building, that may not occur for years, which may not be the Sponsor’s plan.

Increased Share of A Commercial Property’s Expenses

As the Developer’s/Sponsor’s shares of ownership and revenue increase, so may its share of the property’s expenses and other financial obligations. This could present a whole new set of challenges, depending upon the Sponsor’s financial situation and ongoing access to working capital.

Increased Tax Liability

Then, there are the potential tax issues. When a promote crystallization event occurs, all the partners’ ownership shares and share of profits will likely shift, which could have a significant impact on their individual tax liabilities, for the Qualified Opportunity Zone project and, if the project is part of a larger investment strategy, their taxes overall. For this reason, it’s wise to consult an accountant or tax attorney specializing in commercial real estate—Opportunity Zones in particular—before moving ahead with a crystallized promote scenario.

Next, Promote Crystallization, Commercial Real Estate and Financial Modeling

In the third and final installment in our series on The Convergence of Crystallized Promote, Commercial Real Estate and Opportunity Zones, we’ll discuss financial modeling, a critical component of crystallized promote and any commercial real estate deal.

Until then, if you’d like more information on Qualified Opportunity Zones and Qualified Opportunity Zone Funds, we suggest the following resources:

Opportunity Zones – Home | opportunityzones.hud.gov

Opportunity Zones | Internal Revenue Service (irs.gov)

What Is an Opportunity Zone? (investopedia.com)

Opportunity Zones – Map | opportunityzones.hud.gov

Opportunity Zones: What We Know and What We Don’t (taxfoundation.org)

Qualified Opportunity Zones, Funds, and How They Work – NerdWallet

If you’d like more information on Realogic’s services for Qualified Opportunity Zone developers, investors and funds, visit the Opportunity Zones page on our website.

Or, if you’d like more information on Realogic’s financial modeling services for commercial real estate, visit the Financial Modeling Services page on our website.

About The Authors

This post was a collaboration between multiple members of Realogic’s commercial real estate consulting and marketing teams, with each person contributing their unique perspective, experience and specialized expertise. We welcome your comments, questions and feedback. You can reach us at info@realogicinc.com