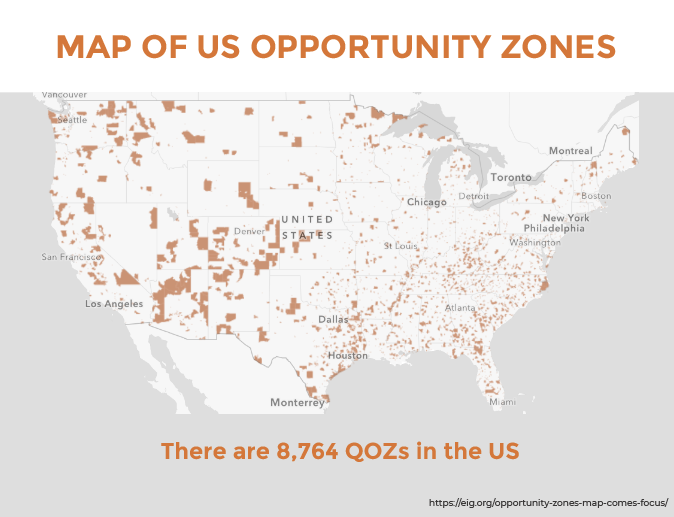

Opportunity Zones, Explained

In 2017, the US Federal Government launched the Qualified Opportunity Zone (“QOZ”) Program to encourage financial investment and commercial real estate development in economically distressed communities across the country. Initially, the program’s benefits included several generous tax breaks, including an immediate partial deferral of taxes on capital gains that are re-invested in Opportunity Zones and a complete waiver of capital gains taxes the QOZ fund generates by holding the investment for 10 or more years.

Additionally, the QOZ Program offered the opportunity to earn stable, long-term returns on real estate investments while bringing new and affordable housing, retail, office and industrial space to underprivileged areas. This unique and compelling combination of financial and social incentives enticed many commercial real estate investors and developers to break ground on a wide range of projects in designated Opportunity Zone areas across the country.

Interest in Opportunity Zones Remains Strong

Although several of the Qualified Opportunity Zone program’s initial benefits have expired, the program still offers many enticing tax breaks:

- Deferment of taxes on prior capital gains reinvested into Qualified Opportunity Zone projects or Qualified Opportunity Zone Funds (QOFs). The deferral lasts until the date the investment is sold or exchanged or December 31, 2026, whichever comes first.

- If the QOZ/QOF investment is held for at least five years, 10% of the deferred gain is exempt from taxes.

- If the investment is held for at least seven years, that increases to 15%.

- In addition, if an investor holds the QOZ/QOF investment for at least 10 years, when the investment is sold or exchanged, any appreciation of the investment is exempt from taxes.

As a result– and understandably– interest in Qualified Opportunity Zones and Qualified Opportunity Zone Funds remains high from investors looking to reduce their tax liability.

The Growing Allure of Promote Crystallization in Commercial Real Estate

At Realogic, we’ve worked on a steady stream of creative and promising Opportunity Zone projects since the program’s inception in 2017. And, as we’ve seen interest in Opportunity Zones and Qualified Opportunity Zone Funds increase steadily over time, we’ve simultaneously seen a noticeable increase in the use of promote crystallization—also known as crystallized carry or carried interest crystallization–in QOZ fund valuations, pitches and negotiations.

Why the steady increase in the use of promote crystallization? Mainly because it can help Opportunity Zone developers, investors and funds accomplish multiple objectives that are key to the financial and operational success of their QOZ projects.

Promote Crystallization In Commercial Real Estate, Explained

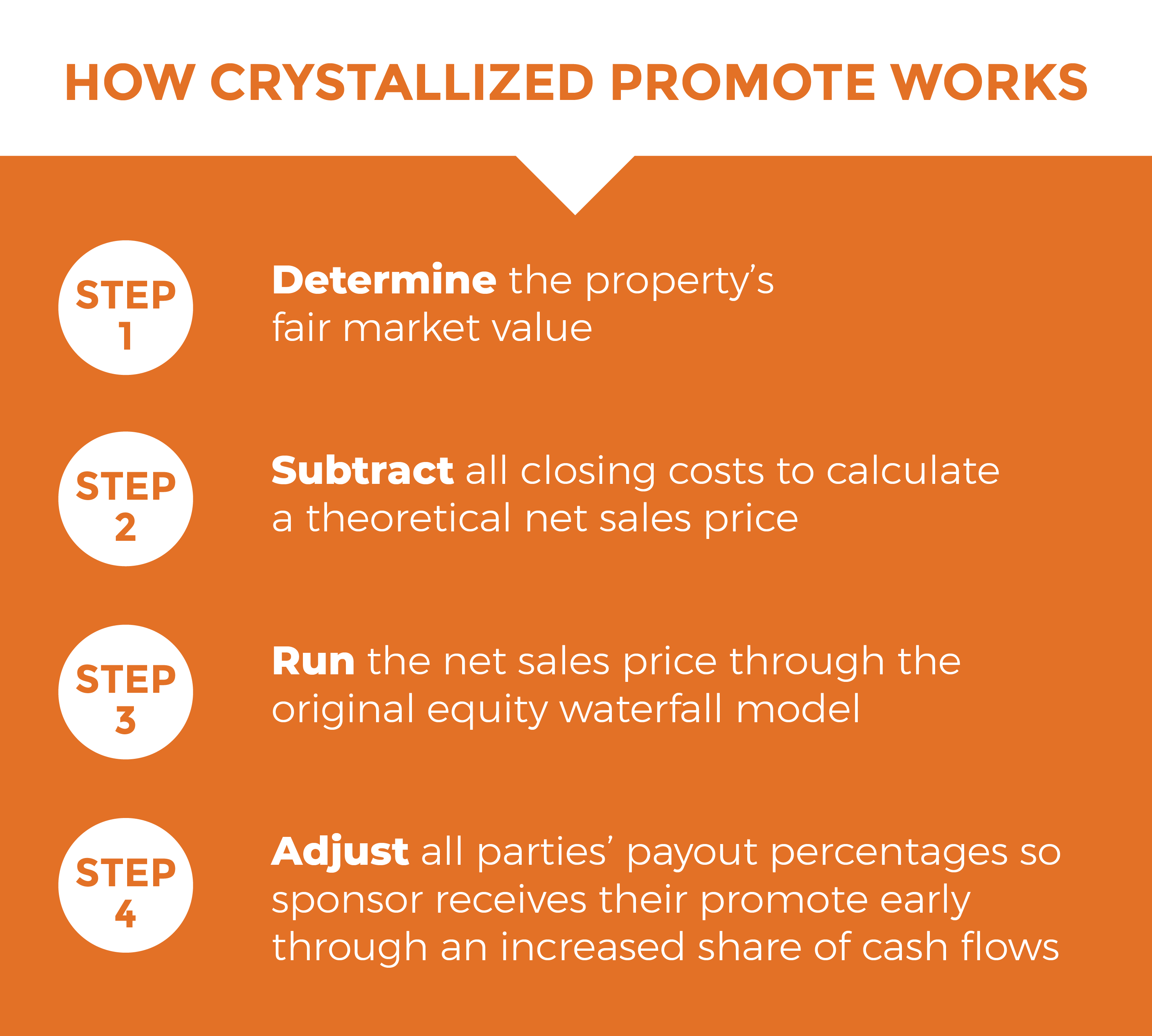

First, before we discuss the myriad benefits, potential drawbacks and various considerations of promote crystallization, we should define the concept. To anyone who’s worked in real estate, investments or finance for any length of time, the concept of crystallized carried interest is probably familiar. In case it’s not, in commercial real estate, promote crystallization works like this:

Fair Market Valuation of the Opportunity Zone Property

The partnership that owns the Opportunity Zone property determines the property’s fair market value, as if it were being sold at the time of crystallization. This is usually done one of two ways: through a professional appraisal, including a detailed valuation model, or through a Broker Opinion of Value, or BOV, from a qualified commercial real estate broker.

Once the property’s fair market value has been determined and agreed upon by all parties, it becomes the hypothetical gross sales price for the property. Closing costs are estimated and deducted from the gross sales price, leaving a net sales price.

Commercial Real Estate Equity Waterfall Models

The QOZ’s net sales price is then run through the partnership’s original equity waterfall model. This calculates what the payouts to all parties would be if the commercial property were sold at the time of crystallization, including the return of original capital and hurdle returns to investors and the promote the project sponsor would receive.

Ownership Share Adjustments

Everyone’s payout percentages are then adjusted accordingly so the sponsor receives their promote early through an increased share of cash flows from the property, rather than having to wait until a future capital event like a sale or refinancing to occur.

The term “crystallization” refers to the value of the sponsor’s or developer’s promote being established at that point in time rather than in the future when the building is sold or refinanced.

An Example of Using Crystallized Promote for an Opportunity Zone Project

Here’s an example of how promote crystallization works in commercial real estate and with Opportunity Zones in particular:

- A developer and group of investors have partnered on a multi-family building in a Qualified Opportunity Zone.

- The developer delivers and stabilizes the building and wants the benefits of their promote early instead of having to wait until the building sells in 10 years. The investors prefer to hold the building for 10 years to receive all the tax benefits from the QOZ program.

- The partnership agrees to use carried interest crystallization to reward the developer now without having to sell or refinance the building.

- The parties agree that the hypothetical fair market value of the building is $100,000,000. Under the original equity waterfall model, the investors receive 80% of the building’s revenue, while the sponsor receives 20%, plus a promote when the building sells.

- After running the $100,000,000 valuation through the equity waterfall model, the sponsor’s promote at that sale price is determined to be a hypothetical $5,000,000.

- In order to pay the sponsor their promote sooner, the sponsor’s share of revenue is increased to 30% while the investors’ share is reduced to 70%. The sponsor eventually collects their full $5,000,000 promote through their increased ownership share of the building.

- When the building does sell, the sponsor does not receive an additional promote, regardless of the building’s actual selling price, because they already received their promote through their increased share of the building’s cash flow.

Next: The Upsides and Potential Downsides of Crystallized Promote in Commercial Real Estate and Opportunity Zone Projects

That concludes Part 1 in our series on The Convergence of Promote Crystallization, Commercial Real Estate and Opportunity Zones. In Part 2, we’ll look at the upsides and potential downsides of promote crystallization as it relates to commercial real estate and Opportunity Zone projects.

Meanwhile, if you’d like to learn more about Realogic’s services, solutions and insights for Opportunity Zone developers, owners and investors, visit the Opportunity Zones page on our website.

For more information on our financial modeling services, including building custom equity waterfall models and modeling promote crystallization scenarios, visit the Financial Modeling Services page on our site.

Sources:

Opportunity Zones Frequently Asked Questions | Internal Revenue Service (irs.gov)

About The Authors

This post was a collaboration between multiple members of Realogic’s commercial real estate consulting and marketing teams, with each person contributing their unique perspective, experience and specialized expertise. We welcome your comments, questions and feedback. You can reach us at info@realogicinc.com