Argus Enterprise Best Practices – Part 2: General Vacancy

Welcome to Part 2 in our series on Argus Enterprise best practices. Part 1 was on reviewing Market Rent Inflation. This post is on another critical component of AE models—General Vacancy.

General Vacancy in Argus Enterprise Models, Explained

General Vacancy in Argus Enterprise (“AE”) is an economic calculation that may reduce asset income to a user-defined market level. In effect, it will set the minimum vacancy loss for the property.

This calculation is often misunderstood by industry professionals and is often conflated with other concepts like physical occupancy, structural vacancy, and leased but unoccupied.

All these concepts coalesce around economic occupancy, but to properly apply them you must understand how AE calculates General Vacancy. The purpose of this article is to explain AE’s General Vacancy functionality and hopefully, once you understand the calculations, you will be able to apply the concepts across the situations you encounter when modeling commercial real estate assets in AE.

General Vacancy vs Leased Occupancy

Proper modeling of General Vacancy is achieved through a series of input and calculations switches within AE. A common misunderstanding is to conflate leased occupancy as seen on an Occupancy Report with the economic inputs of General Vacancy.

Leased occupancy of an asset is only loosely correlated to the General Vacancy calculation in so much that rent– the “economics” — are evenly distributed across the tenancy of the asset.

Examples of General Vacancy in Argus Enterprise Models

Two examples built out in Argus Enterprise will be illustrative. First is a simple scenario to lay the groundwork followed by a more advanced scenario.

Scenario 1: A simple scenario in which leased occupancy and economic occupancy are in sync.

- A 100,000-sf asset comprised of four tenants of equal area– 25,000 sf each — and equal rents of $10/sf Full-Service Gross (no recoveries). All are set to VACATE at the end of their term and are vacant for 12 months upon expiration (Downtime). Tenants expire as follows:

- Tenant 1: End of Year One

- Tenant 2: End of Year Two

- Tenants 3 & 4: End of Year Five

- General Vacancy is set at 25% of Total Tenant Revenue.

- Gross Up Revenue by Absorption and Turnover Vacancy is enabled.

- Reduce General Vacancy Result by Absorption and Turnover is enabled.

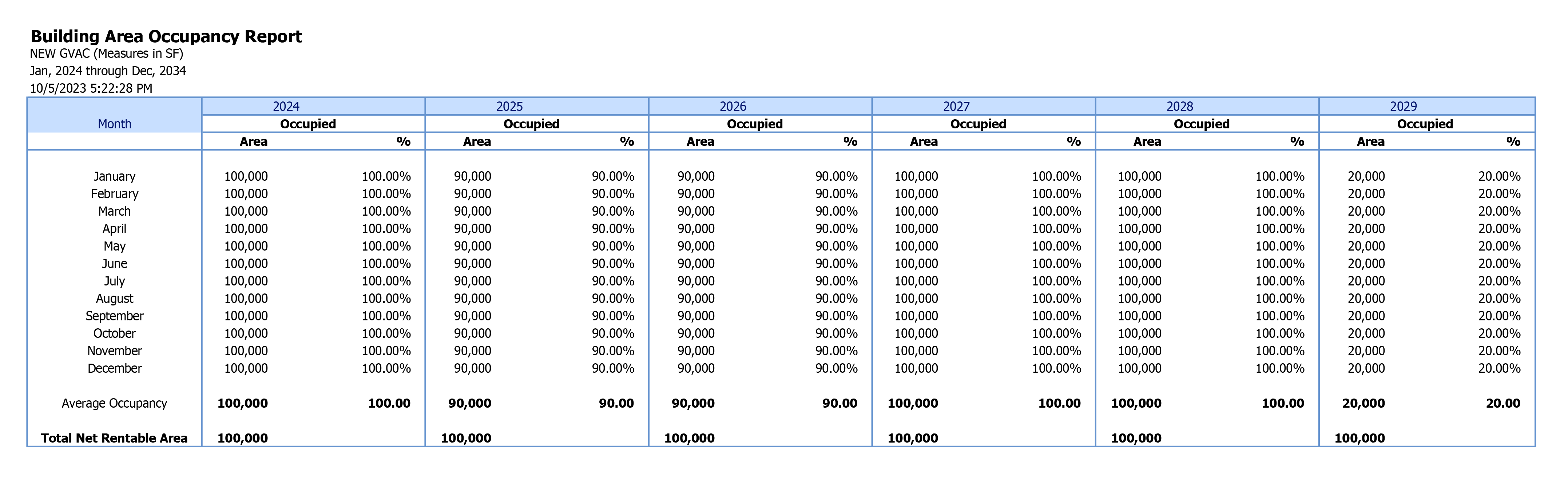

The occupancy and cash flow reports will look as follows:

Vacancy Allowance and Leased Occupancy Are Independent

The main takeaway from this example is that when the building is more than 75% leased, the Vacancy Allowance reduces cash flow and when the building is less than 75% leased there is no additional Vacancy Allowance.

This would leave some to believe that the Vacancy Allowance is dependent on leased occupancy. However, that would be incorrect. Scenario two will show the economic nature of the calculation and highlight the actual mechanics and the proper inputs.

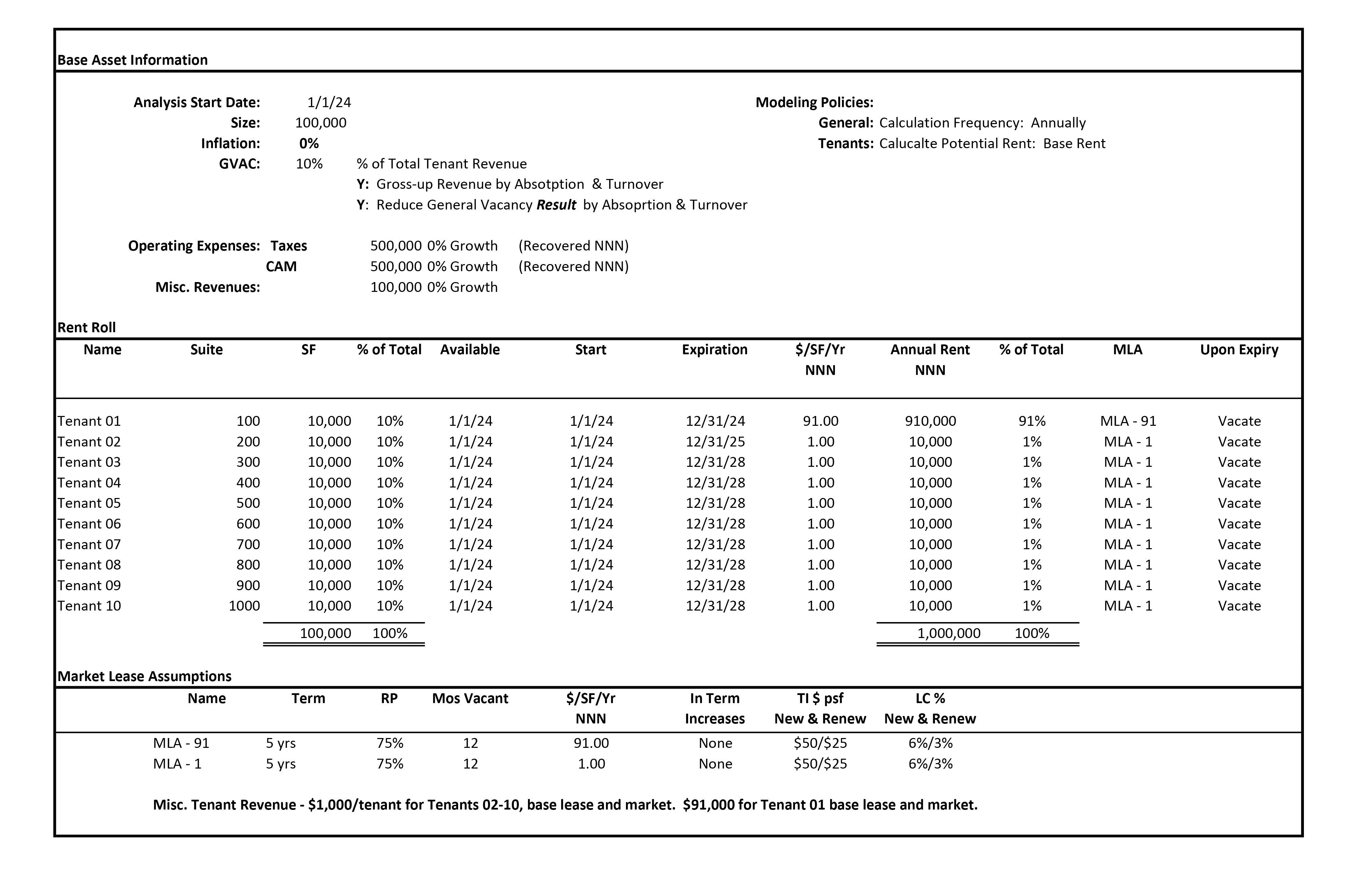

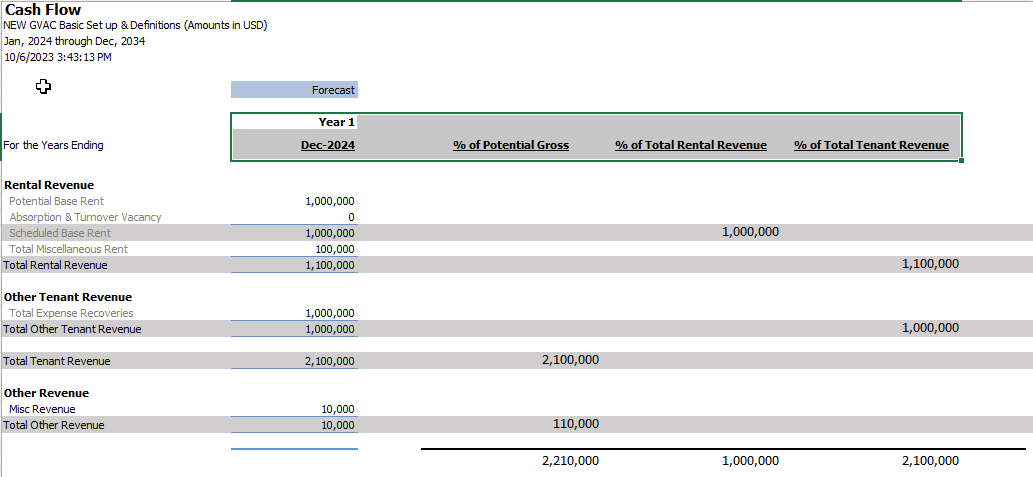

Scenario 2: An advanced scenario highlighting the economic nature of the General Vacancy calculation.

- A 100,000-sf asset comprised of 10 tenants of equal area– 10,000 sf each — but an unequal distribution of rent.

- Base Rent for Tenant 01 is $91.00/sf/yr. (Note: Tenant 01 is 91% of the base rent but only 10% of the physical space). Base Rent for Tenants 02-10 is $1.00/sf/yr. (Note: Tenants 02-10 make up 9% of the base rent but 90% of the physical space). Market terms keep these ratios intact upon rollover of the base leases. Note that this is a highly unlikely distribution of income but will help illustrate the calculations.

- General Vacancy is 10% of Total Tenant Revenue.

- Gross Up Revenue by Absorption and Turnover Vacancy is enabled.

- Reduce General Vacancy Result by Absorption and Turnover is enabled.

- All Tenants “Vacate” at the end of their initial lease term and are vacant for 12 months (Downtime).

- Building expenses are $1,000,000 per year:

- Building Taxes: $500,000

- Building CAM: $500,000

- Pro Rata Share for each tenant = 10% (10,000 sf/100,000 sf)

- Total Expense Recoveries per Tenant per year = $100,000 (10% x $1,000,000)

- Building and Market Inflation is kept at 0% to isolate changes in the cash flow solely due to the General Vacancy calculation.

Setting Argus Enterprise Inputs

For Argus Enterprise to calculate General Vacancy correctly, we will need to review and set inputs on four screens: Rent Roll, General Vacancy and two separate Modeling Policy screens, all of which will be detailed further below.

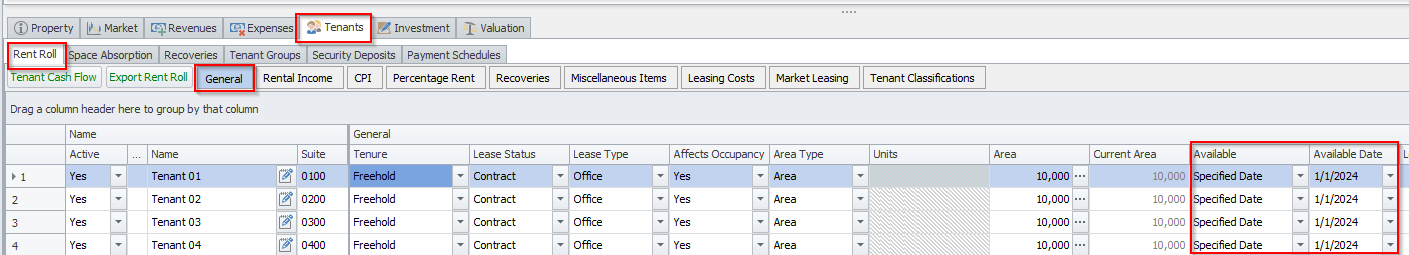

Screen 1 – The Argus Enterprise Rent Roll:

This may appear to be an odd place to start but the Rent Roll is key to calculating Potential Revenue correctly and subsequently Absorption and Turnover. Absorption and Turnover will be used to gross-up revenue and then be deducted from the resultant General Vacancy calculation.

The “Available Date” in the Rent Roll must be properly applied to calculate the “Potential Base Rent” and “Absorption & Turnover Vacancy” correctly. Argus will calculate the “Potential Base Rent” for any entry from the “Available Date” through the latter of 1) Analysis End or 2) Lease Expiry when using “Reabsorb” or any “Upon Expiration” that creates a secondary related line like “Option, Contractual Renewal, Month to Month, or Holdover.”

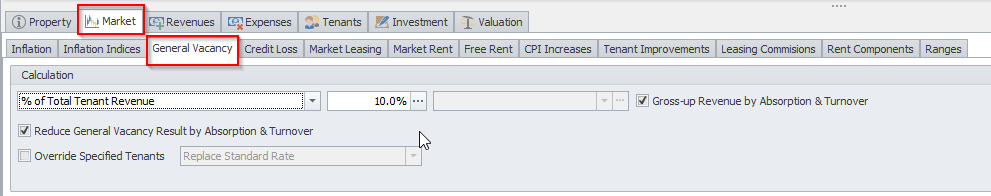

Screen 2 – Market > General Vacancy:

Four basic inputs are required for entering the General Vacancy percentage and to determine which cash flow items are included in the calculation.

Input 1 – Calculation: Four selections are available for the General Vacancy calculation method:

- Annual Amount: An annual amount that will be deducted from the cash flow.

- % of Potential Gross: Total Tenant Revenue + Total Other Revenue

- % of Total Rental Revenue: Scheduled Base Rent + CPI Increases

- % of Total Tenant Revenue: Total Rental Revenue + Total Other Tenant Revenue

Input 2 – Percentage: Enter Percentage or click ellipsis to enter changing percentage over time.

Input 3 – Gross-Up Revenue by Absorption and Turnover: Adds back to the loss due to “Absorption & Turnover Vacancy” to the projected revenue prior to applying the percentage entered in Input 2. This is trying to get to 100% of economic occupancy – vacant space is calculated at market rents and leased space at contractual rents.

Input 4 – Reduce General Vacancy Result by Absorption and Turnover: Once the General Vacancy is calculated, reduce the result by the Absorption and Turnover. The cash flow report will show Vacancy Allowance as zero if absorption and turnover vacancy is greater than vacancy allowance.

Note: “Override Specified Tenants” is not used for this exercise. However, tenants or tenant groups can be modified or excluded from the calculation.

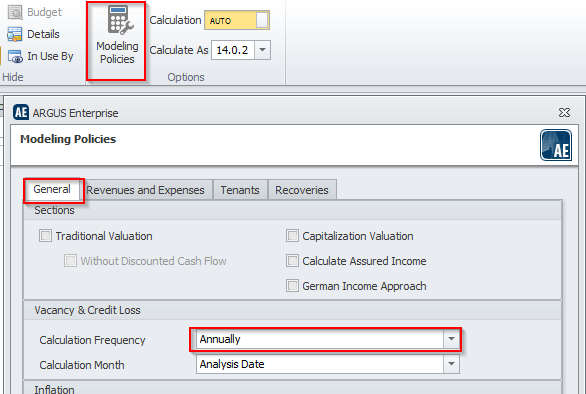

Screen 3 – Modeling Policies > General > Vacancy and Credit Loss: Determination of calculation fiscality and periodicity.

Calculation Frequency: Annually or Monthly. Monthly will calculate based upon the monthly total while Annual calculates based on the annual total. While the Annual calculation is generally more indicative of establishing overall general vacancy at a market level, the monthly calculation will be addressed later in the article.

Calculation Month: Only Available if Calculation Frequency is set to Annual, it denotes beginning of annual calculation.

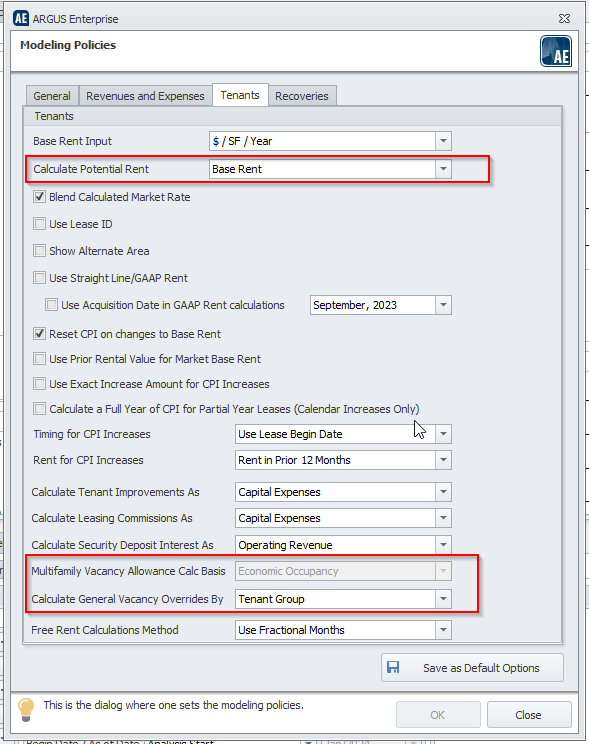

Screen 4 – Modeling Policies > Tenants > Calculate Potential Rent: Definition of Potential Rent on Cash Flow.

Calculate Potential Rent: Determines items to be included for vacant spaces (at rollover and initial lease up). The user has two options:

- Base Rent: Base Rent

- All Tenant Income Less Free Rent: Base Rent, Fixed Steps, CPI, Recoveries, and Percentage Rent

Multifamily Vacancy Allowance Calc Basis & Calculate General Vacancy Overrides By: Beyond the scope of this article.

Argus Enterprise Occupancy and Cash Flow Reports

Earlier it was asserted that leased occupancy of an asset is only loosely correlated with General Vacancy in so much that rent– the “economics” — are evenly distributed across the tenancy. Now that we have the inputs complete, let us analyze the calculations via the Occupancy and Cash Flow reports.

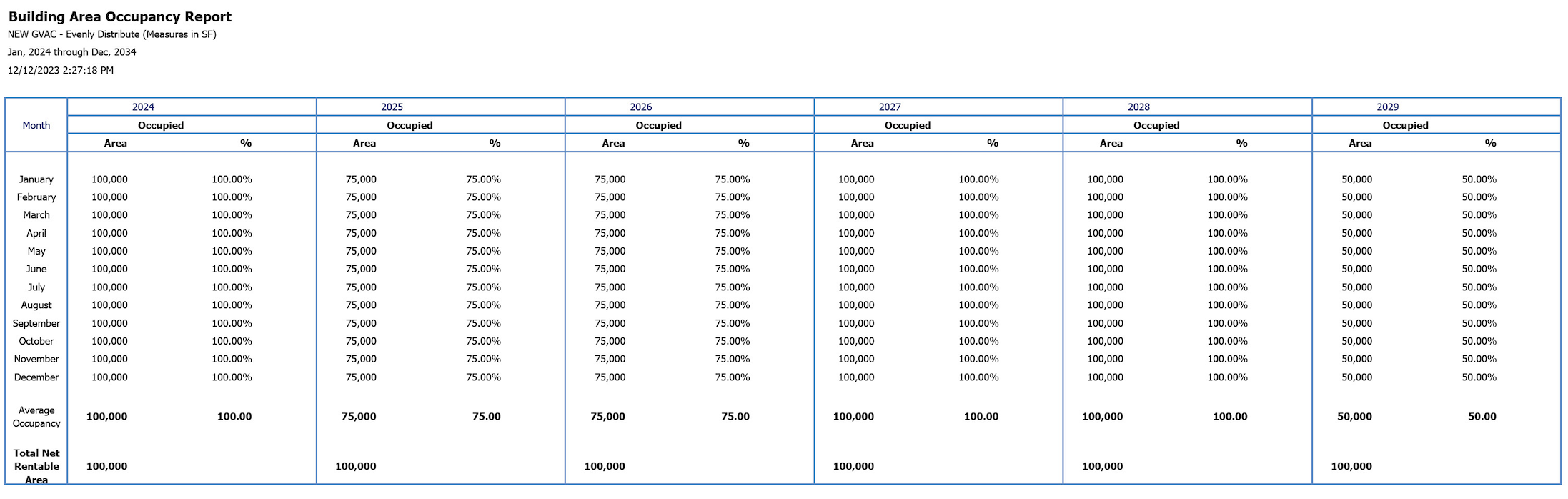

Occupancy Report:

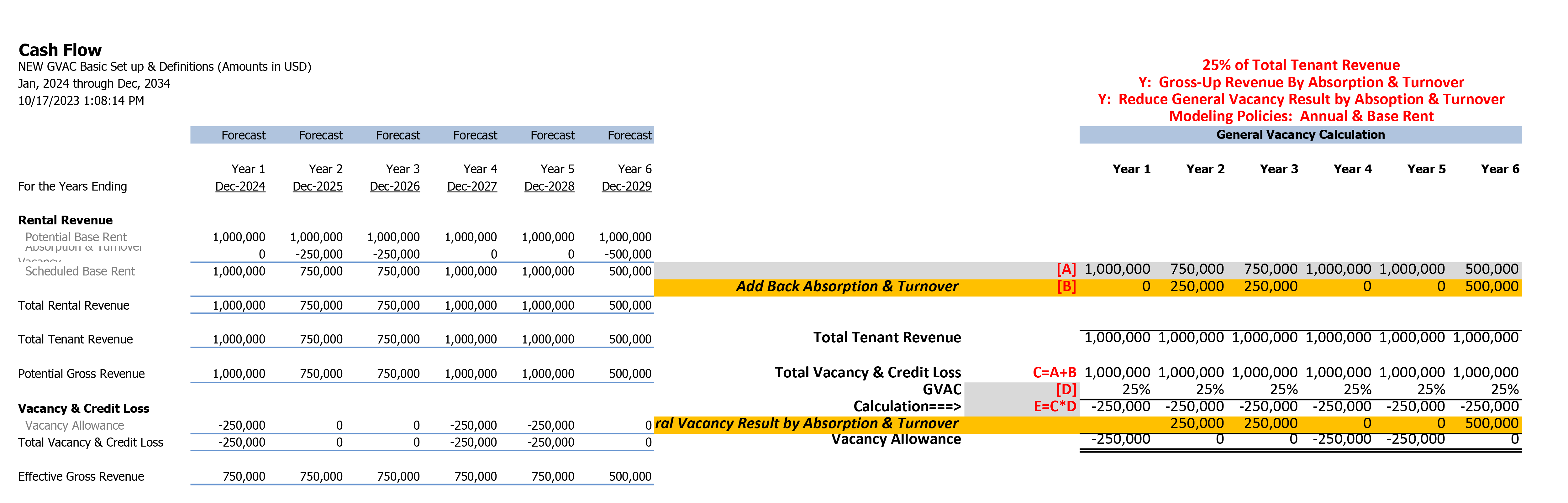

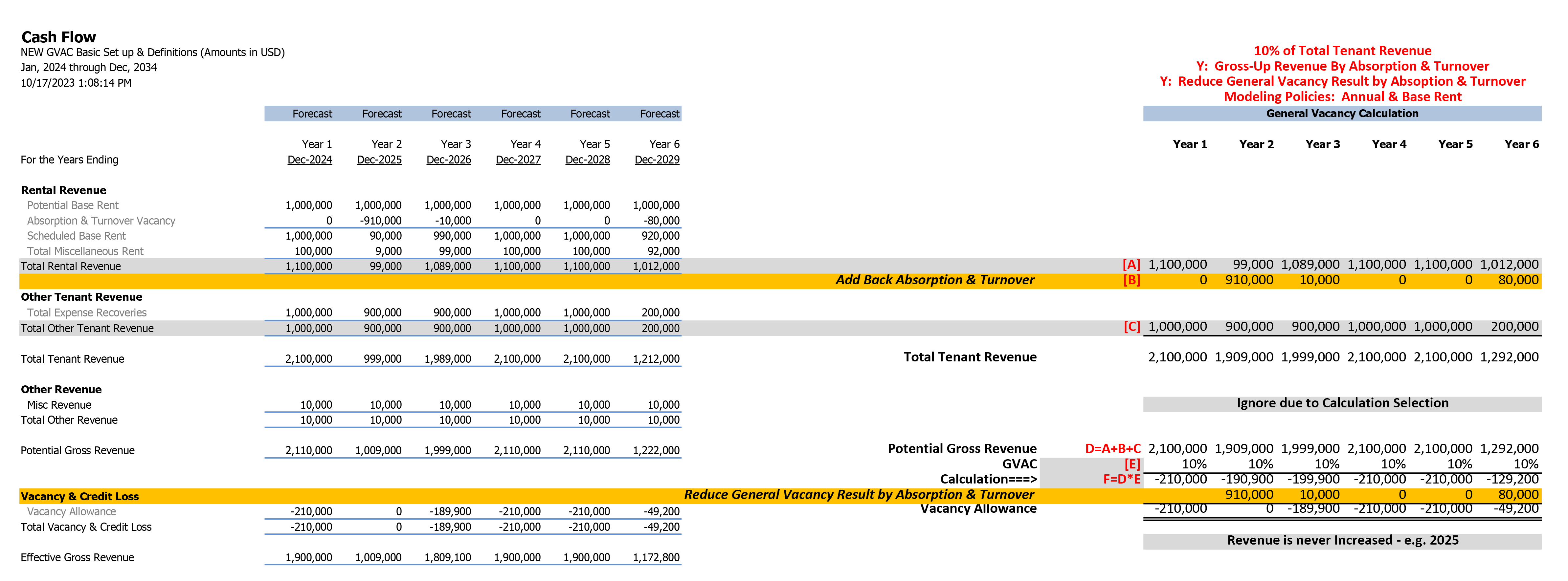

Cash Flow Report:

There are several important observations to be noted in the Occupancy and Cash Flow reports:

- In years one, four and five, the building is 100% occupied and there is no Absorption and Turnover Vacancy. The $210,000 General Vacancy is straightforward based on 10% of “Total Tenant Revenue” with no reduction of the General Vacancy by Absorption and Turnover as none was available.

- In year two, Tenant 01 VACATES and is down for 12 months. Based on the total building rents, Tenant 01 is 91% of the Net Rents. Based upon leased/occupied square footage, Tenant 01 represents 10% of the NRA, resulting in 90% building occupancy per the occupancy report.

The cash flow report shows $910,000 of Absorption and Turnover (Markt Rent of $91/sf*10,000 sf) and the occupancy report shows the 10,000-sf vacant for the 12 months of downtime. No additional General Vacancy is taken as the $910,000 exceeds the General Vacancy calculation, nor is any revenue added back.

- In year three, Tenant 02 VACATES and is down for 12 months while Tenant 01 re-leases once again at 91% of the total Net Rents. Tenant 02 accounts for 1% of the Net Rents and 10% of the leased/occupied. The cash flow report displays $10,000 of Absorption and Turnover (Markt Rent of $1/sf*10,000 sf). This amount is added back prior to the 10% calculation, but then subtracted out of that result. Despite being 90% leased, we must take a large Vacancy Loss as we are highly economically occupied.

- In year six, Tenants 03-10 VACATE and are down for 12 months. The cash flow report shows $80,000 of Absorption and Turnover (Markt Rent of $1/sf*80,000 sf). The $80,000 is added back prior to the 10% calculation, but then removed from the result. Despite the occupancy report showing a 20% leased building, the economics still exceed the required 90% economic occupancy, therefore the resulting General Vacancy.

The above example highlights the economic nature of the General Vacancy calculation. Despite years three and six having lower leased occupancy, we still end up calculating a general vacancy as we are significantly economically occupied.

Two Critical Argus Enterprise Modeling Policies

What if some inputs are adjusted? Beyond inclusion of different cash flow line items via the calculation selections “% of Potential Gross Revenue” or “Total Rental Revenue”, there are two Modeling Policies that can have substantial impact and are often ignored or overlooked:

- Modeling Policies > Tenants > Calculate Potential Rent

- Modeling Policies > General > Vacancy & Credit Loss > Calculation Frequency

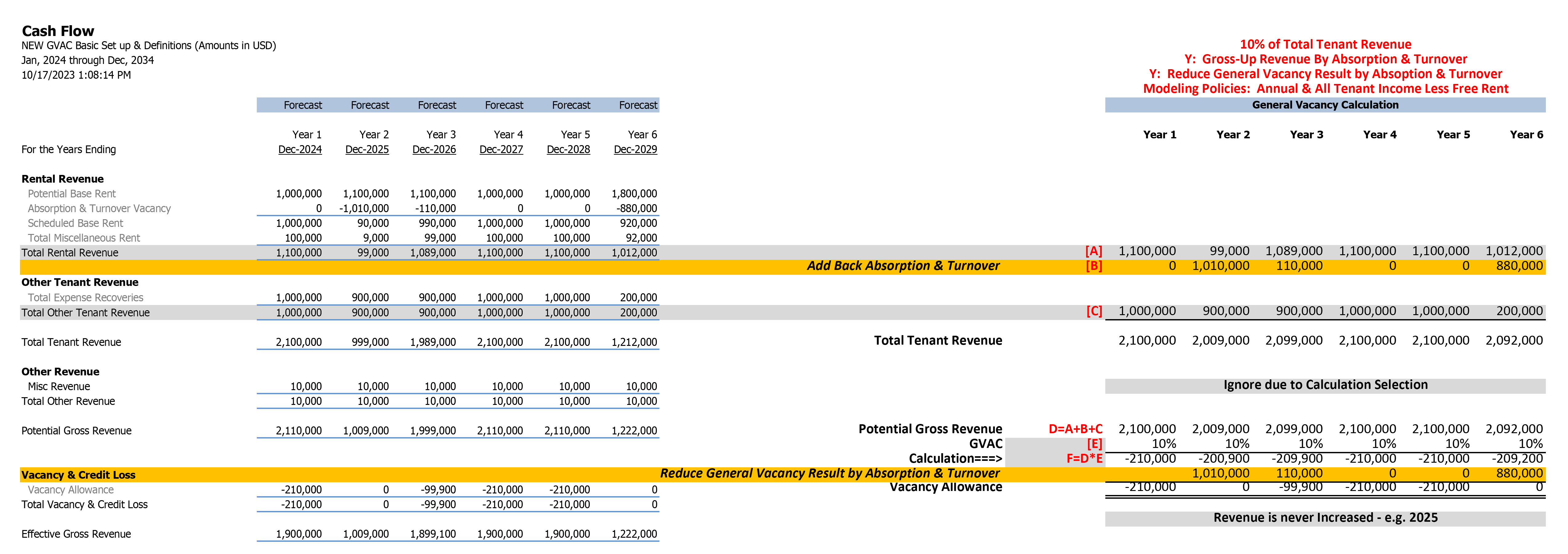

Adding Recoveries to Absorption & Turnover

First, recoveries can be added to the Absorption & Turnover calculation. This can be accomplished as follows: Modeling Policies > Tenants > Calculate Potential Rent to “All Tenant Income Less Free Rent” (All Tenant Income = base rent, fixed steps, CPI, recoveries, and percentage rent. Please note the exclusion of miscellaneous rent). In addition to base rent, the potential base rent will include fixed steps, Consumer Price Index (CPI), recoveries, and percentage rent.

Potential Rent and Absorption & Turnover

Note the change in “Potential Rent” and “Absorption & Turnover” lines to include the recoveries of $100,000 per tenant in any year of rollover. In this instance, years three and six show there is more Absorption & Turnover available to be deducted from the overall General Vacancy calculation, resulting in a lower General Vacancy, and resulting in higher cash flow in this instance.

Calculating General Vacancy on an Annual vs Monthly Basis

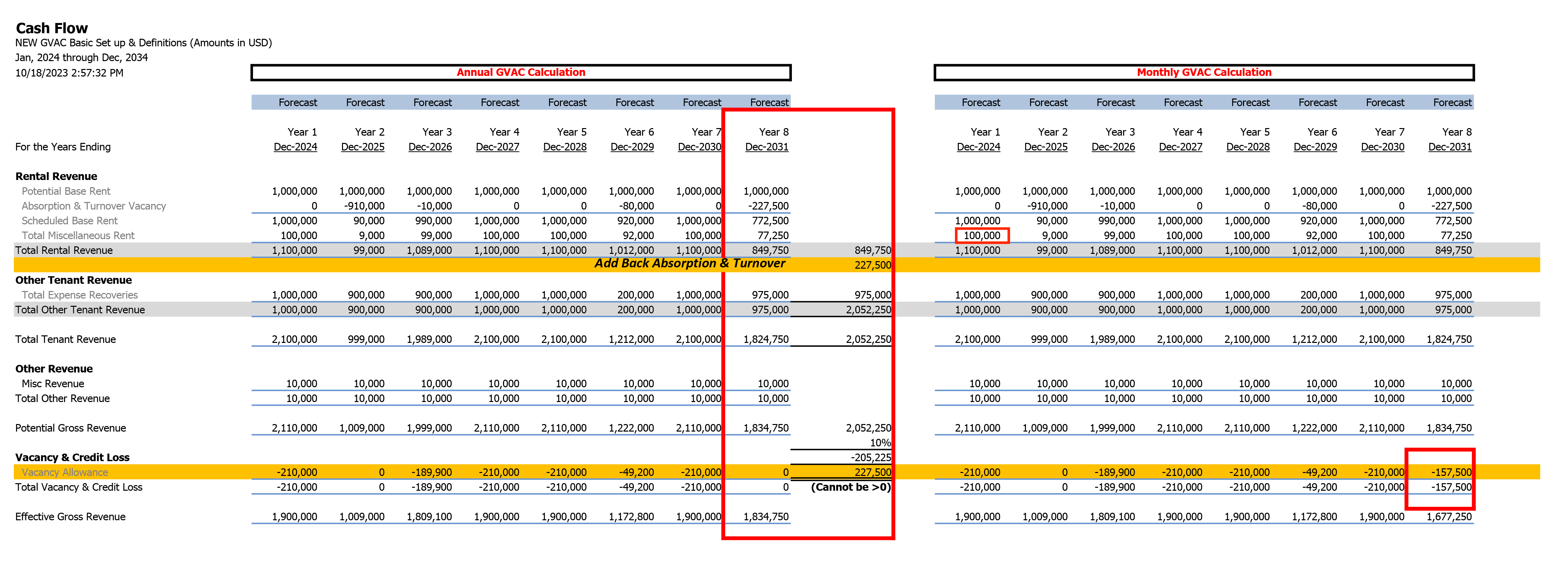

Our second Modeling Policy change will modify the calculation from Annual to Monthly. Let’s make the following changes:

- Modeling Policies > Tenants > Calculate Potential Rent: Base Rent (this will undo the prior example)

- Modeling Policies > General > Vacancy & Credit Loss > Calculation Frequency: Monthly

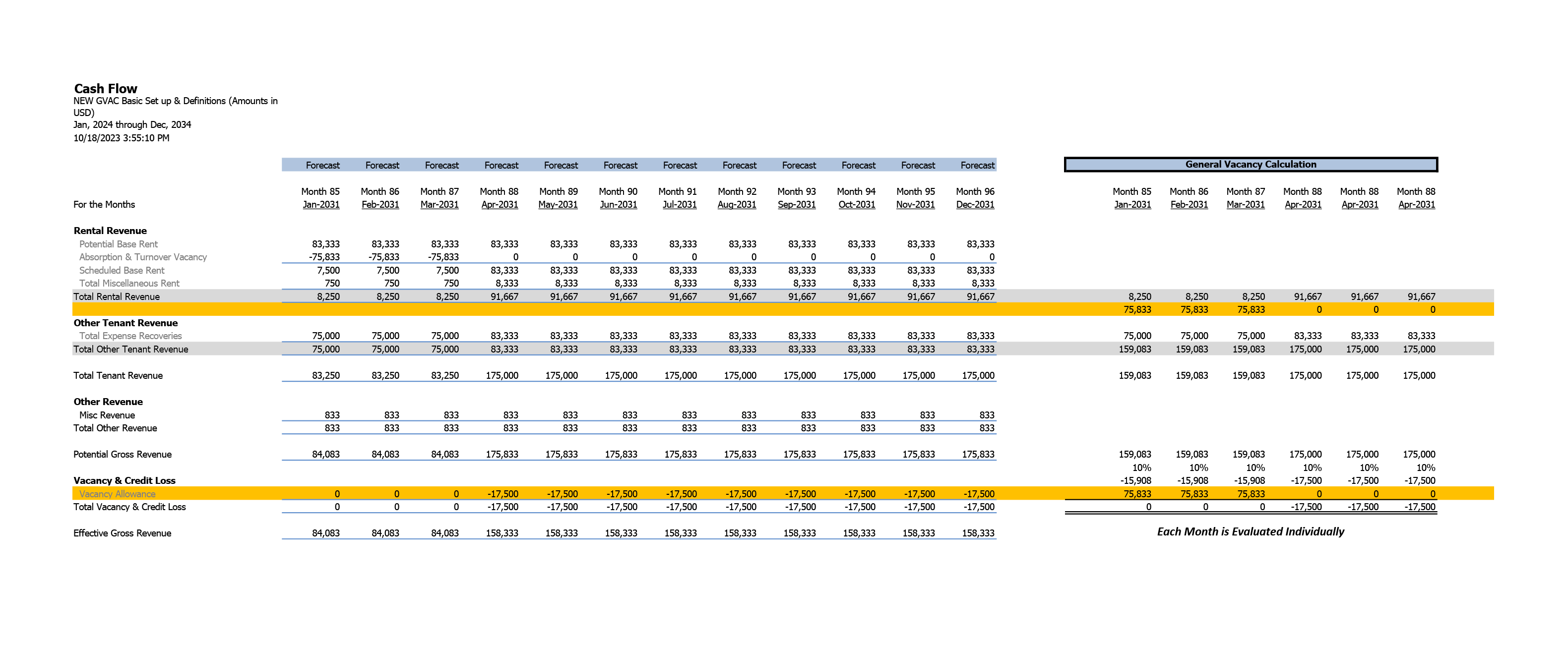

The graphic below compares Year 8 of the analysis, annual calculation on the left, monthly calculation on the right.

Deducted From General Vacancy vs Deducted From Cash Flow

With the Annual calculation on the left side, General Vacancy is at $0 due to the substantial amount of Absorption and Turnover Vacancy being deducted from the General Vacancy result. However, in the Monthly calculation on the right side, we see a substantial amount of General Vacancy being deducted from the cash flow despite the Absorption and Turnover Vacancy being $227,500 in each case.

The $227,500 is Tenant 01 ($91*10,000 sf/12*3) rolling to Market December 31, 2030, and then having three months of downtime– 12 Months weighted on 75% of renewal — and therefore a 25% chance of vacating.

The difference is the Monthly calculation takes place each month independent of every other month while Annual uses the annual totals. See below for the monthly cash flow:

Individually, Months 85, 86 and 87 have ample Absorption and Turnover to offset against the General Vacancy Calculation, while the following months have none and therefore reduce cash flow by the General Vacancy calculation. Using the monthly calculation will never result in more aggressive cash flow.

Individually, Months 85, 86 and 87 have ample Absorption and Turnover to offset against the General Vacancy Calculation, while the following months have none and therefore reduce cash flow by the General Vacancy calculation. Using the monthly calculation will never result in more aggressive cash flow.

A Final Note on General Vacancy in Argus Enterprise Models

While this article has been very detailed, the point is not to ascertain the single correct way to use General Vacancy. If that were the case, the software developers would not have included so many options.

The point is to understand the calculations, which will allow you to apply the proper inputs in your scenario. We hope the roadmap provided proves useful.

Sharpen and Refine Your AE Skills

Hopefully, this article and the first installment in our series on Argus Enterprise best practices will help you model in AE faster and more accurately.

If you’re looking to sharpen your AE skills further, consider one of our Argus Enterprise training courses. We offer two: Modeling in Argus Enterprise- Beginner Level, for those who are just starting out in commercial real estate, are relatively new to the industry or are looking to break into it; and Modeling in Argus Enterprise- Advanced Level, for those with more experience who are looking to take their Argus Enterprise skills to the next level.

Expert Help with Your Argus Enterprise Models

If you could use some expert help with your AE models, Realogic has been building and reviewing Argus Enterprise models for over 30 years.

We’re experts in financial modeling for commercial real estate as well as Argus Enterprise and have built and reviewed thousands of AE models for all types of properties, including distressed office buildings, data centers, multifamily and grocery-anchored strip malls, and transactions.

For more information on our Argus Enterprise modeling services, visit the Financial Modeling page on our website.

About The Author

Jim Pettinger is CEO of Realogic. Named one of CRE’s Best Bosses by commercial real estate publisher GlobeSt. in 2024, Jim has worked in commercial real estate for nearly 30 years and is an expert in financial modeling for real estate as well as Argus Enterprise. Jim has extensive experience in many facets of commercial real estate, including underwriting, due diligence, lease administration, lease abstraction, budgeting and closing support. You can reach Jim at jpettinger@realogicinc.com.