Editor’s Note: We recently updated this post on Pro Rata Share in Commercial Real Estate from 2016, adding new information, expert insights and supporting examples, as well as links to additional resources. To read the updated version of the post on Pro Rata Share, click here.

Editor’s Note: We recently updated this post on Pro Rata Share in Commercial Real Estate from 2016, adding new information, expert insights and supporting examples, as well as links to additional resources. To read the updated version of the post on Pro Rata Share, click here.

Today is the return of the Commercial Lease Fundamentals Blog series for the first time in the new year. If you’ve stumbled onto this post without reading the first two months of the series, you can read through all the previous posts in our blog tagged as “Commercial Lease Fundamentals.”

In the last article posted back on December 11th, I introduced the basic concepts of additional rent including the difference between Gross Leases and Net Leases, as well as the variations contained within each. In today’s post, I’m introducing the concept of Pro Rata Share.

Tenant’s Share may also be referred to as Tenant’s Proportionate Share, Pro Rata Share or simply PRS. It represents the percentage of the Defined Area that is occupied by a particular tenant.

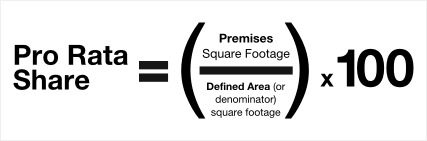

If a tenant occupies 5% of the Defined Area, it is safe to say that the tenant would be responsible for 5% of the costs to operate that Defined Area. In most cases, a Tenant’s Pro Rata Share is determined by the following fraction:

Some leases will clearly state the square footage of the denominator. This will make the tenant’s Pro Rata Share easy to calculate and verify. Other leases may simply state a percentage amount. In either case, unless the lease states otherwise, a tenant’s stated pro-rata share or the stated building square footage cannot change when calculating the tenant’s share in subsequent years. That is, it cannot change unless an amendment or other documentation is executed evidencing such change.

Some leases are written to allow the landlord to recalculate the tenant’s Pro Rata Share from year-to-year based upon building re-measurements.

Other PRS subtleties

- If a denominator square footage is not explicitly stated, be sure to identify the mechanics that make up the denominator. In some cases, it will be based on the square footage of a single building but occasionally, it is calculated on the sum of a combination of buildings. In other cases, the Proportionate Share denominator is based on use (Retail tenants have their own denominator while office tenants have a different denominator. It’s rare but it happens).

- The denominator for the Pro Rata Share calculation being based upon “occupied” square footage or “95% of building square footage.”

- Varying Pro Rata Shares for Operating Expenses vs. Real Estate Taxes for the same tenant.

- A tenant’s Pro Rata Share being based on some other leased square footage and not the square footage it is occupying per the lease.

In next week’s installment, scheduled for January 15th, I’ll dig deeper into operating expenses. I’ll specifically identify items commonly included or excluded in operating expense calculations as well as the rules that govern caps on operating expense increases.