Editor’s Note: We recently updated this post on Percentage Rent in Commercial Real Estate from 2016, adding new information, expert insights and supporting examples, as well as links to additional resources. To read the updated version of the post on Percentage Rent, click here.

Editor’s Note: We recently updated this post on Percentage Rent in Commercial Real Estate from 2016, adding new information, expert insights and supporting examples, as well as links to additional resources. To read the updated version of the post on Percentage Rent, click here.

In last week’s post, I introduced the much misunderstood concept of Gross Up: how it sometimes gets a bad reputation but is actually intended to protect both the landlord and the tenant. In today’s article, I’ll define and explain the retail-specific mechanism of Percentage Rent.

Percentage Rent Defined

Percentage Rent is a form of rent paid in addition to, or in lieu of, Base or Minimum Rent. It is almost exclusively reserved for retail tenants and is based upon a percentage of the tenant’s gross sales, with or without a breakpoint.

Breakpoint: Natural or Fixed

Breakpoints may be ‘natural’ or a fixed dollar amount.

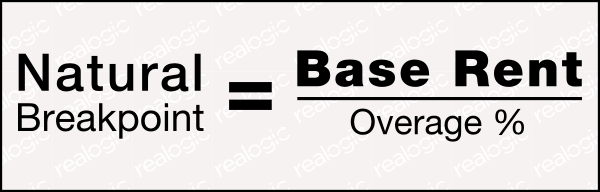

- A ‘natural’ breakpoint reflects the amount of Gross Sales which, when multiplied by the Overage Percentage, equals Base Rent (stated differently, a natural breakpoint is calculated as Base Rent divided by the Overage Percentage). The Overage Percentage is stated in the lease.

- If a breakpoint is not natural, then the amount of the breakpoint (stated as an absolute Gross Sales amount or Gross Sales per square foot) is arbitrarily determined based upon negotiation between the landlord and tenant.

As an additional aide, here is a visual representation of the Natural Breakpoint concept.

The following is an example of a Percentage Rent calculation that also may help to explain how percentage rent works in the real world.

Percentage Rent Example

In addition to its Minimum Rent, a tenant is obligated to pay 5% of its gross sales over a natural breakpoint. The Minimum Rent is $12,000 annually.

First, determine the natural breakpoint:

| Base Rent | Overage Percentage |

|---|---|

| $12,000 | 5% |

Using our Natural Breakpoint formula, perform the calculations to identify the natural breakpoint:

$12,000 ÷ 0.05 = $240,000.00

With this number, we now know that the tenant will be required to pay the landlord, in addition to its $12,000 of Minimum Rent annually, 5% of all gross sales in excess of $240,000.

The tenant will submit gross sales reports to the landlord according to the terms of this lease. The report is due at the end of the year showing all of the gross sales for the year.

In this case, the gross sales were $425,000. Here’s how to calculate the amount due to the landlord:

| Annual Gross Sales: | $425,000.00 |

|---|---|

| Less Breakpoint | – $240,000.00 |

| Sales over Breakpoint | $185,000.00 |

$185,000.00 x 5% = $9,250.00

The landlord is entitled to $9,250.00 in Percentage Rent.

In closing, I’ll mention a few other factors that come into play when collecting Percentage Rent.

- As Base Rent changes, so too does the natural breakpoint;

- a lease will define payment periods and indicate whether or not the breakpoint is cumulative;

- a lease will indicate whether LL is entitled to recapture against percentage rent due of expense recoveries;

- Some breakpoints will be tiered (i.e., overage percentage changes as the level of sales increases);

- LLClusions/exclusions from gross sales and the potential for multiple sales categories. For example, a convenience store may have a different percentage rent rate for food as opposed to lottery tickets.

That’s it for Percentage Rent. If you would like more information about the retail side of commercial real estate, download the free CLF Cheat Sheet available beneath this article. Remember also to stop by next Wednesday when I’ll introduce another often-confusing topic: Consumer Price Index and its usage in Commercial Real Estate Leases.