An In-Depth Look at Commercial to Residential Conversions—Part 10

This is the 10th installment in our in-depth series on commercial to residential conversions.

In Part 7, we discussed how the number of office to residential conversions has skyrocketed over the last four years, from 12,100 units in the pipeline in 2021 to a record 70,700 units in early 2025.

In Part 8 and Part 9, we looked at some of the reasons for the spike, including the current states of the US office, multifamily and housing markets.

In this post, we look at another reason for the recent surge in office to apartment conversions– the long list of US federal government programs and resources meant to encourage local community revitalization and economic development efforts, including the conversion of underused office buildings into multifamily living space.

US Federal Government Incentives and Resources for Commercial to Residential Conversions

While US state and local governments have led the effort to convert more struggling office buildings into apartments — subjects we’ll cover in subsequent chapters– many departments of the US federal government and their bureaus offer expert guidance, helpful resources and generous financial incentives to help speed up and defray the cost of community development projects, including some office to residential conversions, to make them more attractive to commercial real estate developers, owners, investors and lenders.

A Comprehensive Guidebook to Available Federal Resources for Commercial to Residential Conversions

In 2023, recognizing that office to apartment conversions could help cities and municipalities address two significant problems plaguing them—a severe shortage of housing and a growing glut of distressed office buildings– the Biden administration created a guide titled “Commercial to Residential Conversions: A Guidebook to Available Federal Resources” that outlined all the programs and resources offered by the US federal government that could potentially lower the cost of conversions and posted the guidebook on the White House website.

The Trump administration has since removed the guidebook from the White House website and discontinued some of the programs in it, most notably financial incentives from the EPA for certain clean and renewable energy projects. However, many of the US federal government incentives and resources noted in the guidebook are still in place, while others have been modified but are still available.

What Help for Commercial to Residential Conversions Does the US Federal Government Currently Offer?

Here’s a rundown of the Federal government departments and bureaus that currently offer guidance, financial assistance and other resources to help ease the cost of and speed up adaptive reuse projects, including office to apartment conversions, as well as what those programs entail:

US Department of Housing and Urban Development (HUD)

Program: FHA Mortgage Insurance—Section 221d4

- FHA Mortgage Insurance Section §221(d)(4) provides mortgage insurance for HUD-approved lenders to help encourage the construction and substantial rehabilitation of multifamily rental or cooperative housing for moderate-income families, older adults and people with disabilities. Mortgages for Single Room Occupancy (SRO) projects also may qualify for the §221(d)(4) program.

- By insuring lenders against loss on mortgage defaults, the §221(d)(4) program helps make capital more readily available for certain office to apartment conversions and the development of other types of housing for moderate-income and displaced families.

- Eligible borrowers include public, for-profit sponsors; limited distribution, nonprofit cooperatives; builder-seller, investor-sponsor and general mortgagors.

Program: FHA Mortgage Insurance—Section 220

- FHA Mortgage Insurance Section 220 insures loans for multifamily housing projects in urban renewal and code enforcement areas and areas where other revitalization efforts are occurring.

- The mortgage insurance is for HUD-approved lenders only. Insured mortgages can be used to develop or rehabilitate numerous types of rental housing, including detached, semi-detached, row, walk up or elevator-type, or to purchase multifamily properties that have already been rehabilitated, so long as the property consists of two or more units and is located in an urban renewal area.

- Eligible borrowers include private, for-profit entities, public bodies and other parties that meet HUD requirements for mortgagors.

Program: HOME Investment Partnerships Program (HOME)

- The HOME program is the largest federal block grant for state and local governments created specifically to support the creation of affordable housing.

- The HOME program provides formula grants to state and local governments—often in partnership with local nonprofits—to fund a wide range of initiatives, including acquiring, building, buying and rehabilitating affordable rental housing, or for providing direct rental assistance to low-income renters.

- Entities eligible for HOME grants include US states, local jurisdictions, communities and certain consortiums of local jurisdictions.

Program: National Housing Trust Fund (HTF)

- The HTF is a formula grant program meant to complement other federal, state and local efforts to increase and maintain the supply of affordable housing for extremely low-income (≤30% AMI) households.

- HTF funds can be used for a variety of purposes, including the financing, acquisition, construction, reconstruction or rehabilitation and operating of non-luxury housing with suitable amenities.

- Grantees are required to use at least 80% of each annual grant for rental housing, up to 10% for homeownership housing and up to 10% for the grant recipient’s administrative and planning costs.

- The HTF program is administered by US states. A state can administer the funds itself or designate an entity to administer the program on its behalf.

Community Development Block Grant Program (CDBG)

- One of HUD’s most popular and successful programs, the Community Development Block Grant Program provides annual formula grants to states, cities and counties to develop quality urban housing and expand local economic opportunities, primarily for low and moderate-income residents.

- Eligible grantees include principal cities of Metropolitan Statistical Areas (MSAs), metropolitan cities with populations of at least 50,000, Qualified Urban Counties with populations of at least 200,000 and states and insular areas.

- CDBG funds can be used for numerous initiatives, including property acquisition, rehabilitation of residential and non-residential structures, activities related to energy conservation and renewable energy, relocation and demolition and assisting for-profit businesses with economic development and job creation initiatives.

Program: Section 108 Loan Guarantee Program (Section 108)

- HUD’s Section 108 Loan Guarantee Program works in conjunction with its Community Development Block Grant program by providing guaranteed loans to CDBG grant recipients, giving them access to low-cost, flexible financing for additional economic development, housing, public facility and infrastructure projects.

- Program participants can use their guaranteed loans to finance specific projects or to start loan funds to finance multiple projects over several years. Cities and counties often use the Section 108 program to catalyze private investment and economic activity in underserved areas or to fill financing gaps in critical community projects.

Program: Thriving Communities Technical Assistance Program (TCTA)

- The TCTA was created to support the planning, coordination and integration of transportation and housing into community infrastructure projects undertaken by state and local governments and Native American tribes.

- These projects, which can include transportation, water system, high-speed internet accessibility, environmental remediation and electrical grid initiatives, can help jurisdictions revitalize underserved communities, create economic opportunities for residents and businesses and improve housing availability, affordability and quality.

- Units of general local government (UGLG) are eligible for the TCTA program if they:

-

- Will be receiving transportation funding, either directly or through a state pass-through

- Want to address housing needs in their disadvantaged communities

- Want to work on at least one of the four TCTA priorities

- Are committed to community engagement to ensure residents and businesses in disadvantaged communities benefit from transportation investment

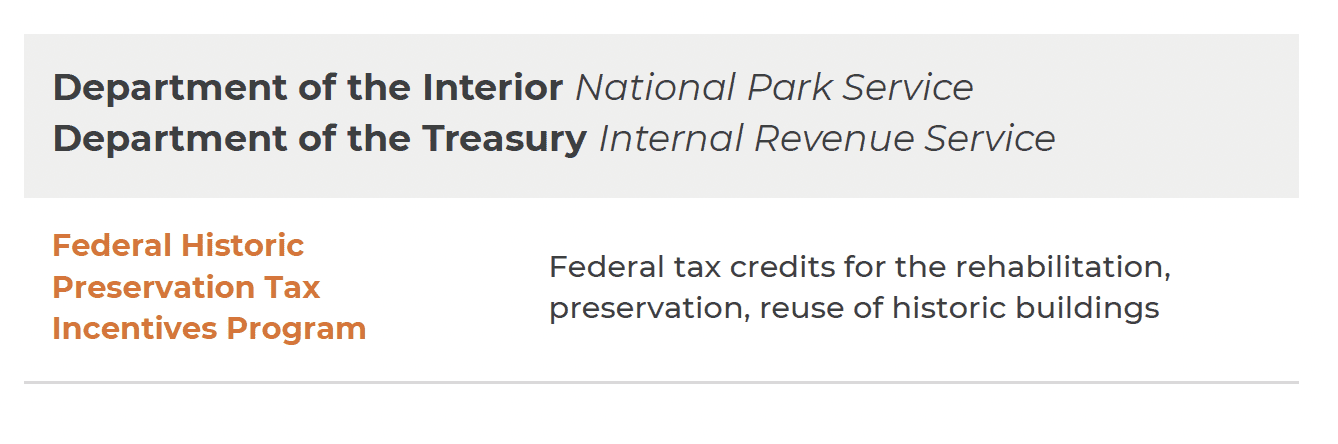

US Department of the Interior- National Park Service (NPS) and the US Department of the Treasury- Internal Revenue Service (IRS)

Program: Federal Historic Preservation Tax Incentives Program

- The Federal Historic Preservation Tax Incentives Program is one of the federal government’s longest running and most successful community development and property revitalization programs and its most significant financial investment in the preservation of the nation’s historic buildings. Since the program was established in 1976, it has leveraged over $235 billion in private investment to preserve over 50,000 historic buildings across the US.

- The Department of the Interior and Department of the Treasury jointly administer the Federal Historic Preservation Tax Incentives Program (HTC) through the National Park Service and IRS, respectively, and through a partnership with the State Historic Preservation Offices.

- The Federal Historic Preservation Tax Incentives Program provides federal tax credits to individuals and entities that rehabilitate income producing, historically significant buildings, making it a critical source of gap funding for such projects and a catalyst for public-private partnerships.

- According to the IRS, the amount of the tax credit is determined in the taxable year the building is placed in service and is equal to 20 percent of qualifying expenditures.

- To qualify for the program, a property must be certified as historically significant through the National Park Service.

- Parties eligible for the tax credits include individuals, corporations, partners, shareholders and beneficiaries of passthrough entities and estates and trusts.

US Department of Energy (DOE)- Loan Programs Office (LPO)

Program: Title 17 Clean Energy Financing Program

- The Title 17 Clean Energy Financing Program provides federal financing for clean energy and energy infrastructure projects in the US that reduce greenhouse gas emissions and air pollution.

- Two main loan products are offered through the LPO’s Title 17 program; direct loans from the US Treasury’s Federal Financing Bank (FFB), which are 100% backed by a Department of Energy guarantee; and partial guarantees of up to 90% of commercial debt from the DOE. Most guarantees are for loans of over $100 million.

- To qualify, a project must:

-

- Be located in the US

- Be energy-related

- Achieve a significant, credible reduction in air pollution or greenhouse gas emissions

- Have a reasonable prospect of repayment

- Involve viable and commercially ready technology

- Cannot benefit from prohibited federal support

- The One Big Beautiful Bill Act, signed into law by President Trump on July 4, 2025, expanded the scope of projects eligible for the Title 17 Clean Energy Financing Program, authorizing loan guarantees up to a total principal amount of $250 billion through September 30, 2028 for initiatives that enhance energy production, critical minerals development and grid reliability.

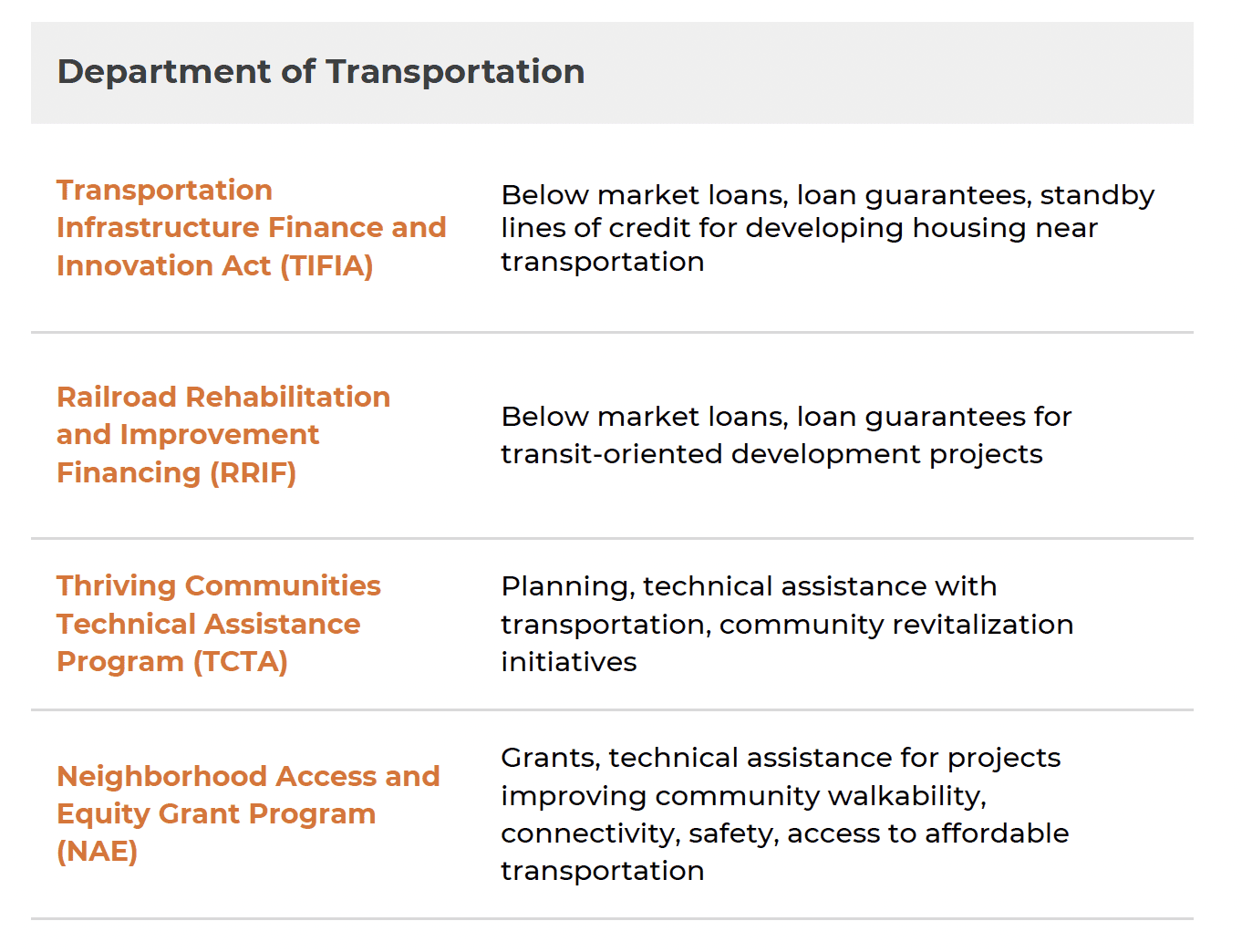

US Department of Transportation (DOT)

Program: Transportation Infrastructure Finance and Innovation Act (TIFIA)

- The US Department of Transportation’s TIFIA program is a key source of gap funding for transportation related projects and it helps foster private-public partnerships.

- The TIFIA program provides credit assistance for qualifying transportation infrastructure projects of regional or national significance, including highway, transit, railroad, intermodal freight and port access projects.

- Those eligible include state and local governments, transit agencies, railroad companies, special authorities, special districts and private entities.

- Three types of financial assistance are offered through the TIFIA program: low, fixed interest direct loans, loan guarantees and standby lines of credit.

- Up to 49% of a qualifying project’s costs can be financed through the TIFIA program. Interest rates do not start accruing until the proceeds are drawn.

- Amortization terms are flexible; up to a 35-year repayment period—75 years in some cases– and deferrable until five years after the project is deemed substantially complete.

Program: Railroad Rehabilitation and Improvement Financing (RRIF)

- Through the RRIF program, the Department of Transportation is authorized to provide direct loans and loan guarantees of up to $35 billion for the development of railroad infrastructure, $7 billion of which is reserved for projects benefiting most freight railroads.

- RRIF funds can be used for a wide range of projects, including transit-oriented development projects; acquiring, improving or rehabilitating intermodal or rail equipment and facilities, including buildings; developing new intermodal or railroad facilities; reimbursement of planning and design expenses for these projects; and to finance transit-oriented development.

- Direct loans can fund up to 100% of a railroad project with repayment periods of up to 35 years and interest rates equal to the US Treasury rate.

- Eligible entities include railroads, state and local governments, sponsored authorities and corporations, and joint ventures that include at least one of those.

Program: Thriving Communities Technical Assistance Program (TCTA)

In addition to being offered through HUD, the TCTA program is also offered through the Department of Transportation. The TCTA program provides technical assistance to state and local governments and Native American tribes to help them integrate transportation and housing into community infrastructure projects.

Neighborhood Access and Equity Grant (NAE)

- The Neighborhood Access and Equity Grant Program (NAE) provides grant funding and technical assistance to state and local governments and their entities to improve community walkability, safety and access to affordable transportation.

- Three types of grants are available through the NAE program: Community Planning Grants, Capital Construction Grants and Regional Partnership Challenge Grants for projects led by two or more applicants to address a persistent regional challenge.

- Projects eligible for Community Planning Grants include a wide range of planning studies and public engagement activities.

- Projects eligible for Capital Construction Grants include design activities and associated environmental studies; removal, retrofitting and mitigation of some facilities; replacing certain facilities with new ones that restore community connectivity; and the reuse of a facility to improve walkability, safety and access to affordable transportation.

- Parties eligible for NAE grants include US States and territories, local government units, political subdivisions of States, Tribal governments, special purpose districts or public authorities with a transportation function, Metropolitan Planning Organizations and nonprofit organizations, and institutions of higher education that have formed a partnership with one of those previous organizations to benefit disadvantaged and underserved communities.

- NAE grants will cover up to 80% of a project’s costs and require a 20% local match, but no local match if the project is in a disadvantaged or underserved community.

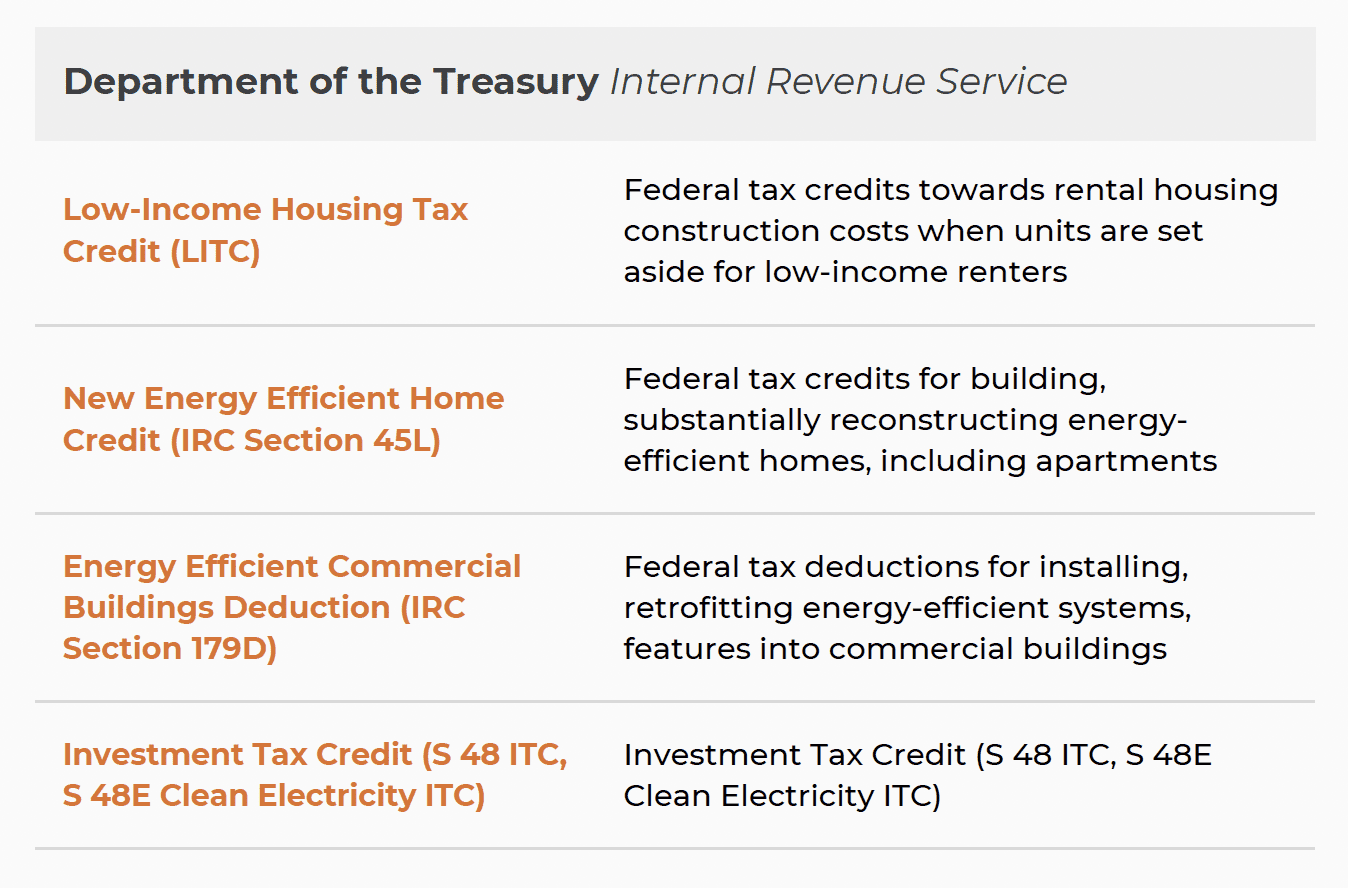

US Department of the Treasury- Internal Revenue Service (IRS)

Program: Low-Income Housing Tax Credit Program (LIHTC)

- Although the Low-Income Housing Tax Credit Program is sponsored by the federal government, it is primarily administered at the state level by state housing finance agencies (HFAs). At the federal level, the program is overseen by the IRS’ Office of the Taxpayer Advocate Service, which provides grants to organizations that assist low-income taxpayers with tax-related issues.

- The LIHTC program is the federal government’s primary means of supporting the development of affordable rental housing. Through the LIHTC program, developers receive federal tax credits to help offset the cost of constructing rental housing if they set aside a certain percentage of units for low-income renters.

- Developers can claim tax credits in equal amounts over 10 years. To generate upfront financing and reduce the amount of debt and other financing needed for a project, developers often sell the tax credits to outside investors—often financial institutions—in exchange for equity in the project.

- Two types of tax credits are offered through the LIHTC program, the 9% credit and the 4% credit.

- The 9% credit is generally reserved for new construction and rehabilitation projects that do not utilize additional federal subsidies. It was originally designed to equate up to a 70% total subsidy.

- The 4% credit is usually used for projects that also utilize federally tax-exempt bonds and it was originally designed to provide up to a 30% subsidy.

Program: Energy-Efficient Home Tax Credit (Section 45L)

- Under Section 45L of the IRS’ Internal Revenue Code, developers who build or substantially reconstruct energy-efficient homes can claim federal tax credits of up to $5,000 per single family home and as much as $5,000 per multifamily unit.

- The amount of the tax credit allowed depends on several factors, including the type of home, its level of energy efficiency, when it was or will be acquired, and for multifamily units, whether prevailing labor wage requirements were met.

- To qualify for the Energy-Efficient Home Tax Credit, a home or multifamily unit must meet either the Energy Star or Zero Energy Ready Home programs’ energy efficiency standards as well as all requirements under IRC Section 45L and IRC Section 45L (c).

Program: Energy-Efficient Commercial Buildings Deduction (Section 179D)

- The IRS’ Energy-Efficient Commercial Buildings Deduction is a federal tax deduction property owners may qualify for if they develop an energy-efficient commercial building property (EECBP) or retrofit a commercial building to be energy efficient– in IRS parlance an EEBRP—and place it into service.

- For a retrofitted building to qualify, the energy-efficient retrofits must be to the building’s interior lighting, HVAC, ventilation or hot water systems or to the building’s envelope.

- For commercial buildings placed into service in 2025 and beyond, the deduction is equal to the full cost of the property or is calculated on a per square foot basis based upon the building’s maximum energy savings, whichever is less.

- The amount of the allowable deduction increases if the building meets higher energy savings standards or prevailing wage and apprenticeship requirements.

- Under The One Big Beautiful Bill Act, construction of a property must begin by June 30, 2026 in order for that property to qualify for this tax break.

Program: Investment Tax Credits (Section 48 and Section 48E)

- Eligible tax-exempt and governmental entities, including state and local governments, Native American Tribes, religious organizations and non-profit organizations, can use the investment tax credits under Sections 48 and 48E of the IRS tax code to help offset the cost of certain clean energy projects.

- The Section 48 ITC applies to a broad range of energy generation and storage initiatives, including the construction of solar, wind, geothermal and biogas facilities.

- The Section 48E tax credit—also known as the Section 48E Clean Electricity ITC—applies only to energy projects that achieve net zero greenhouse gas emissions. These include the construction of wind, solar, nuclear, hydropower and geothermal energy facilities and the development of energy storage technologies like batteries.

- The amount of the tax credits are based upon several factors, primarily the facility’s maximum net energy output. Various bonus credits can be earned on top of the base credits.

- Under the One Big Beautiful Bill Act, which substantially modified the federal government’s clean energy policy, to qualify for the Section 48E Clean Electricity ITC, a project must be placed into service by December 31, 2027, unless construction begins before July 4, 2026.

Our Short, Handy Guide To US Federal Government Programs, Incentives and Resources for Office to Residential Conversions

For your convenience and quick reference, we have created a handy guide listing and concisely outlining all of the US federal government’s programs and resources for office to residential conversions and related community development projects and posted it in the Library on our website.

Next Up, State-Level Policies, Resources and Incentives for Office to Apartment Conversions

Next in our in-depth series on multifamily conversions, we’ll cover state policies and incentives designed to encourage office to residential conversions. Meanwhile, in case you missed them, here are links to the three most recent posts in our series on commercial to residential conversions:

- Part 7: Office to Apartment Conversions Update- Q2 2025

- Part 8: Multifamily Sector Update- Q2 2025

- Part 9: The US Housing Market- 2025

Commercial Real Estate Underwriting, Financial Modeling, Due Diligence, Lease Abstraction and More

Realogic has extensive experience with adaptive reuse projects, including office to apartment conversions, and can help with several aspects of your next office to residential conversion, including underwriting, due diligence, financial modeling, lease abstraction and loan abstraction.

For more information, contact us at info@www.realogicinc.com or 312-782-7325.

About The Author

Terry Banike is Vice President of Marketing for Realogic. Over the course of his career, he has worked in marketing, communications, journalism and public relations, and has written news stories and features for newspapers, trade publications, newsletters and blogs. A rabid reader of anything and everything on commercial real estate, Terry closely follows commercial real estate news and trends and frequently posts about real estate on the Realogic Blog. He can be reached at tbanike@www.realogicinc.com.

Sources:

- 1-Commercial Edge; A Guide to Public Policies Supporting Office-to-Residential Conversions; Timea Iancu; October 2, 2024

- 2-John Burns Research and Consulting; New Federal Program Seeks to Jump-Start Office-to-Residential Conversions; Deana Vidal; January 26, 2024

- 3-CLA; Federal Programs to Assist with Commercial to Residential Conversions; October 31, 2023

- 4-US Department of Energy LPO; Title 17 Clean Energy Financing Program

- 5- Worktraining.com; DOE Amends Loan Guarantee Regulations to Implement Energy Dominance Financing Under OBBA; October 30, 2025

- 6-National Park Service; Tax Incentives for Preserving Historic Properties; May 27, 2025

- 7-US Department of Transportation- Build America Bureau Credit Programs Office; TIFIA Program Overview; October 29, 2025

- 8-US Department of Transportation- Build America Bureau Credit Programs Office; Railroad Rehabilitation and Improvement Financing (RRIF); July 15, 2025

- 9- US Department of Transportation; Thriving Communities Program; January 22, 2025

- 10- US Department of Transportation; NAE Frequently Asked Questions; November 2025

- 11-Federal Housing Administration (FHA) Mortgage Insurance; New Construction or Substantial Rehabilitation of Rental Housing: §221d4

- 12- Federal Housing Administration (FHA) Mortgage Insurance; Rental Housing for Urban Renewal and Concentrated Development Areas: § 220

- 13- Department of Housing and Urban Development; Proposed Changes in Mortgage Insurance Premiums Applicable to FHA Multifamily Insurance Programs; June 26, 2025

- 14- Department of Housing and Urban Development; HOME Overview; November 2025

- 15- Council for Affordable and Rural Housing; HUD HOME Investment Partnership Program Updates and Effective Dates; April 17, 2025

- 16- National Housing Trust Fund Factsheet; November 2025

- 17- Department of Housing and Urban Development; Community Development Block Grant Program; September 6, 2024

- 18- Department of Housing and Urban Development; Section 108 Loan Guarantee Program (Section 108); June 10, 2025

- 19- Department of Housing and Urban Development; Thriving Communities Technical Assistance Overview; November 2025

- 20-US Department of Agriculture; Rural Development; Multifamily Housing Programs; November 2025

- 21- US Department of The Treasury; Policy Issues; October 2025

- 22- For all tax credit programs, US Internal Revenue Service (IRS.gov)

- 23- US Department of Energy; Section 45L Tax Credits for DOE Efficient New Homes

- 24- US Department of Energy; 179D Energy Efficient Commercial Buildings Tax Deduction

- 25-Kirkland & Ellis; “The One Big Beautiful Bill Act” Is Signed Into Law By President Trump: Key Changes to Environmental Programs; July 25, 2025

- 26- Congress.gov; An Introduction to the Low-Income Housing Tax Credit; Mark P. Keightley; July 11, 2025

- 27- Brookings; Understanding Office-to-Residential Conversion: Lessons from six US case studies; Cara Eckholm; Tracy Hadden Loh, Jonathan Meyers; Steve Paynter; March 26, 2025